Vault is a unique online mutual fund portfolio tracker that analyses your portfolio and tracks its real-time movements. It also provides convenient access to research reports and tracks your investments across all platforms and corners of the financial market. Vault portfolio trackers help investors monitor and manage their investments efficiently. Vault is a free mutual fund portfolio tracker, so investors can easily avail of its benefits without worrying about additional charges.

The Vault tracker provides a comprehensive overview of your investments. It showcases your sector and category split, highlights your top-performing fund, and illustrates your equity-debt ratio, clearly showing how balanced your portfolio is.

Tracking your investments is not trivial, but Vault makes it much more manageable with its user-friendly interface and simple navigation.

How is Vault Going to Help you?

Investment Overview

You can check the amount you invested in funds, your current investment, and your investment's profit or loss.

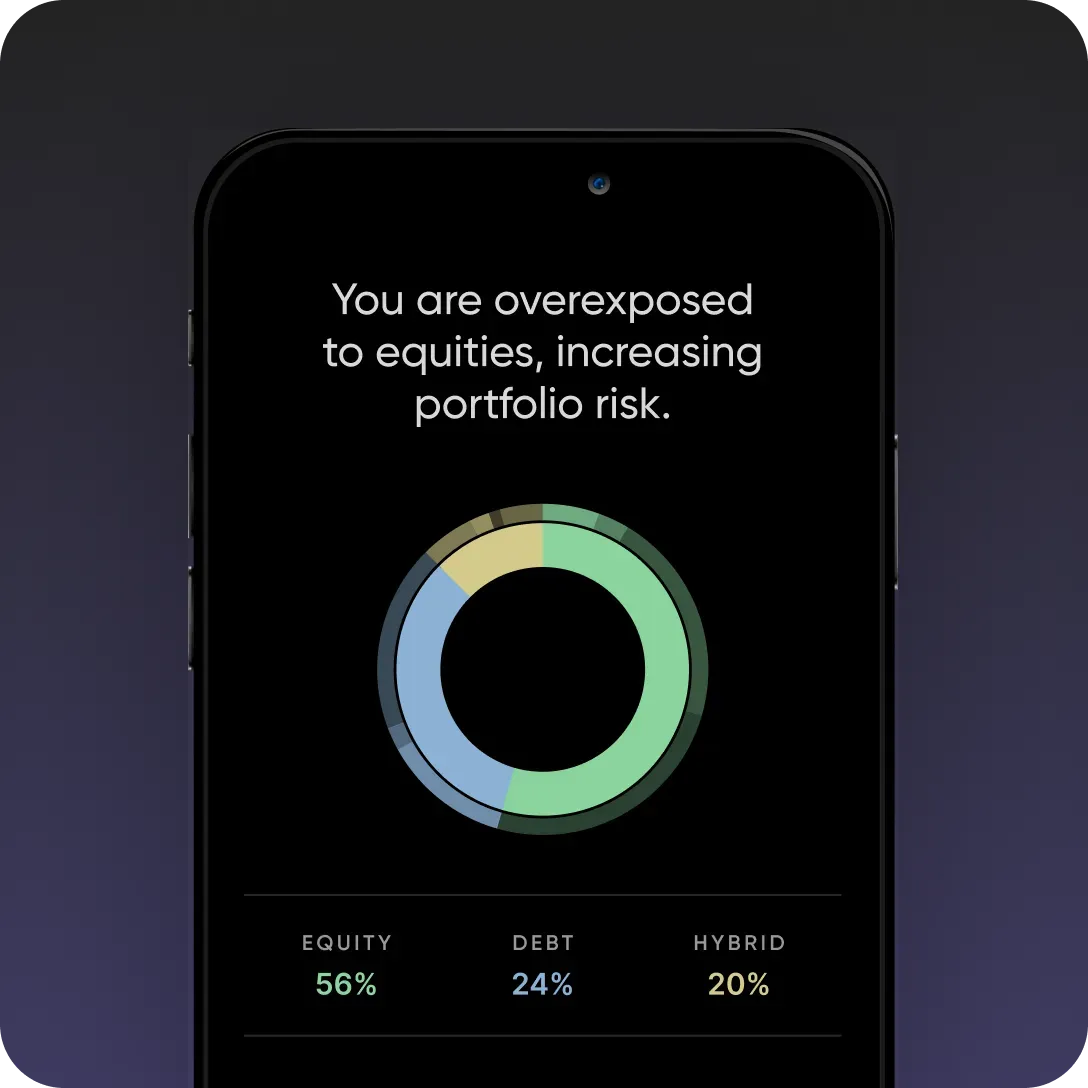

Asset Allocation

You can review the allocation of investments across different asset categories, such as equities, fixed income, commodities, or cash.

Investment Holdings

One of the best features Vault has introduced is the ability to identify the specific investments in each account, including bonds, mutual funds, and exchange-traded funds (ETFs).

Top Companies

Your investments are divided into categories, including top-performing and bottom-performing companies, making it easier for you to identify further which companies to invest in.

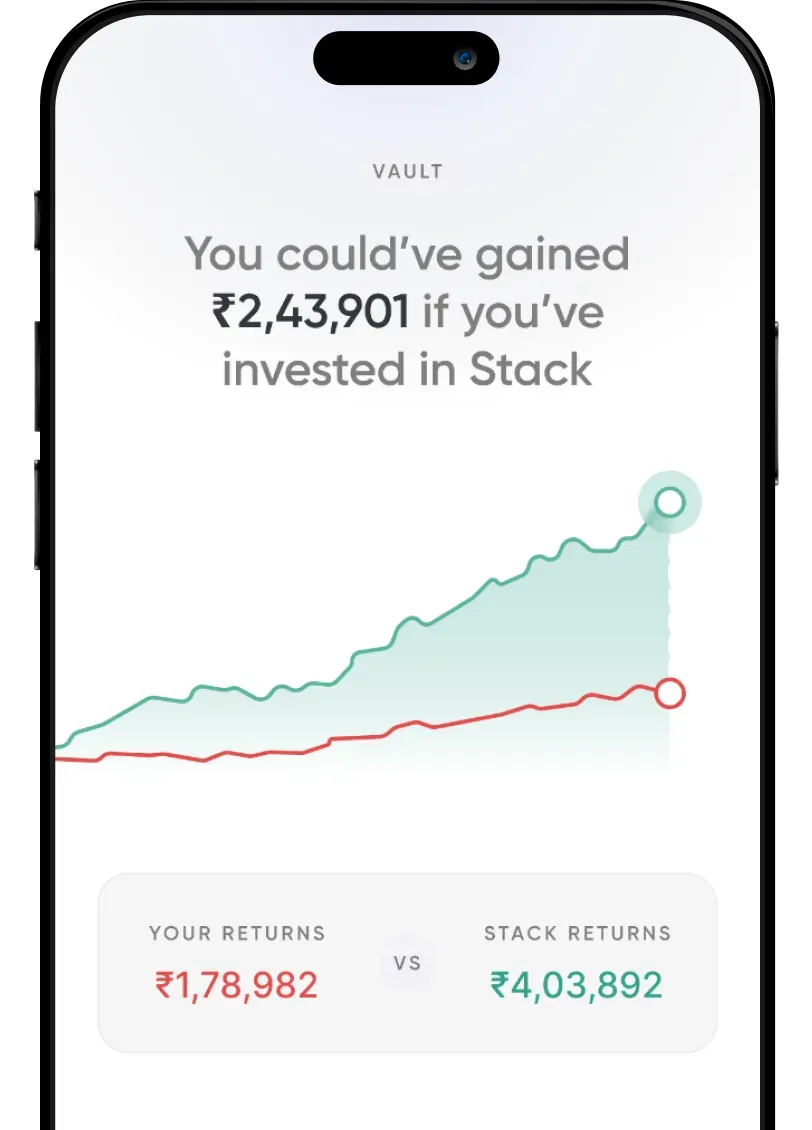

Benchmarking

We compare each fund's performance to a relevant benchmark, such as the NIFTY or SENSEX.

Risk Assessment

We consider each fund's level of risk, including factors such as credit risk, volatility, and liquidity risk.

Return Analysis

Further, it also evaluates the returns yielded by each fund over different periods.

Fund Performance

Our experts analyse the performance of your existing funds, identifying those that are underperforming or no longer aligning with your investment goals.

Risk Tolerance

We consider your risk tolerance, ensuring our recommendations align with your comfort level with market volatility.

Market Volatility

Our experts consider current market conditions and detect potential risks and opportunities that may impact your investments.

Steps to Use Vault

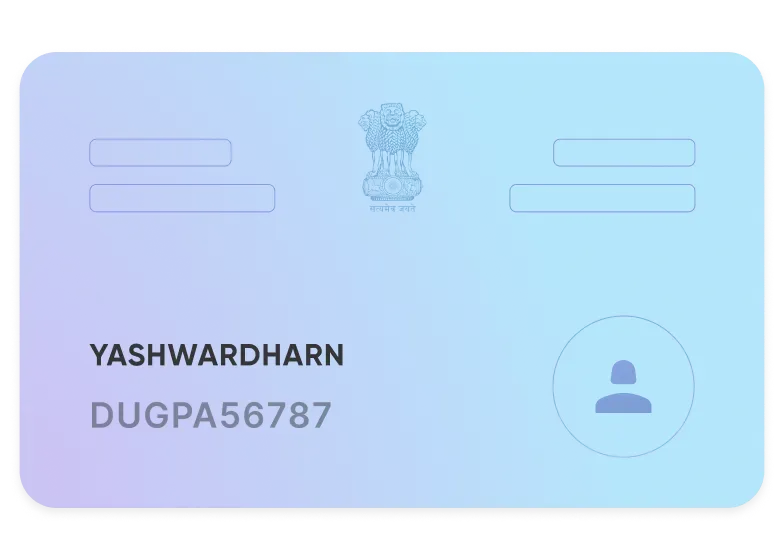

These steps link your Permanent Account Number (PAN) to Vault, a mutual fund portfolio tracker. Here's a breakdown of each step:

Step 1: Enter Your PAN Details

You must input your Permanent Account Number (PAN), a unique 10-character alpha-numeric code.

Step 2: We Will Fetch Your Details From MFCentral

MFCentral is a centralised database of mutual fund investors. When you provide your details to the platform, it will verify your PAN and retrieve your existing investment information.

Step 3: Vault Will Analyse Your Funds

Once your details are fetched, Vault will analyse your existing investments and funds to provide a comprehensive view of your financial portfolio.

With Vault, you can stay updated with real-time performance insights into your investments, returns, ups and downs, and more!