Flagship

Flagship

your core portfolio for long-term wealth creation

powered by

Flagship portfolio is designed to help you achieve long-term financial goals while maximizing risk-adjusted returns

In this blog, we'll delve into the details of the Flagship Portfolio, and its benefits. We will also provide credible historical Indian stock market data, specifically from the NIFTY index, to validate its potential for long-term wealth creation.

introducing Flagship

your core portfolio

The Flagship Portfolio recognizes the significance of diversification across different asset classes. By allocating your capital to a judicious mix of asset classes with low correlation, viz., domestic equities, international equities, bonds, and precious metals, we aim to reduce the portfolio risk (measured through annual volatility via Sharpe Ratio and max portfolio drawdown) and enhance long-term growth potential. Let's explore the historical performance of these asset groups in relation to the NIFTY index, showcasing the effectiveness of diversification in generating wealth over time.

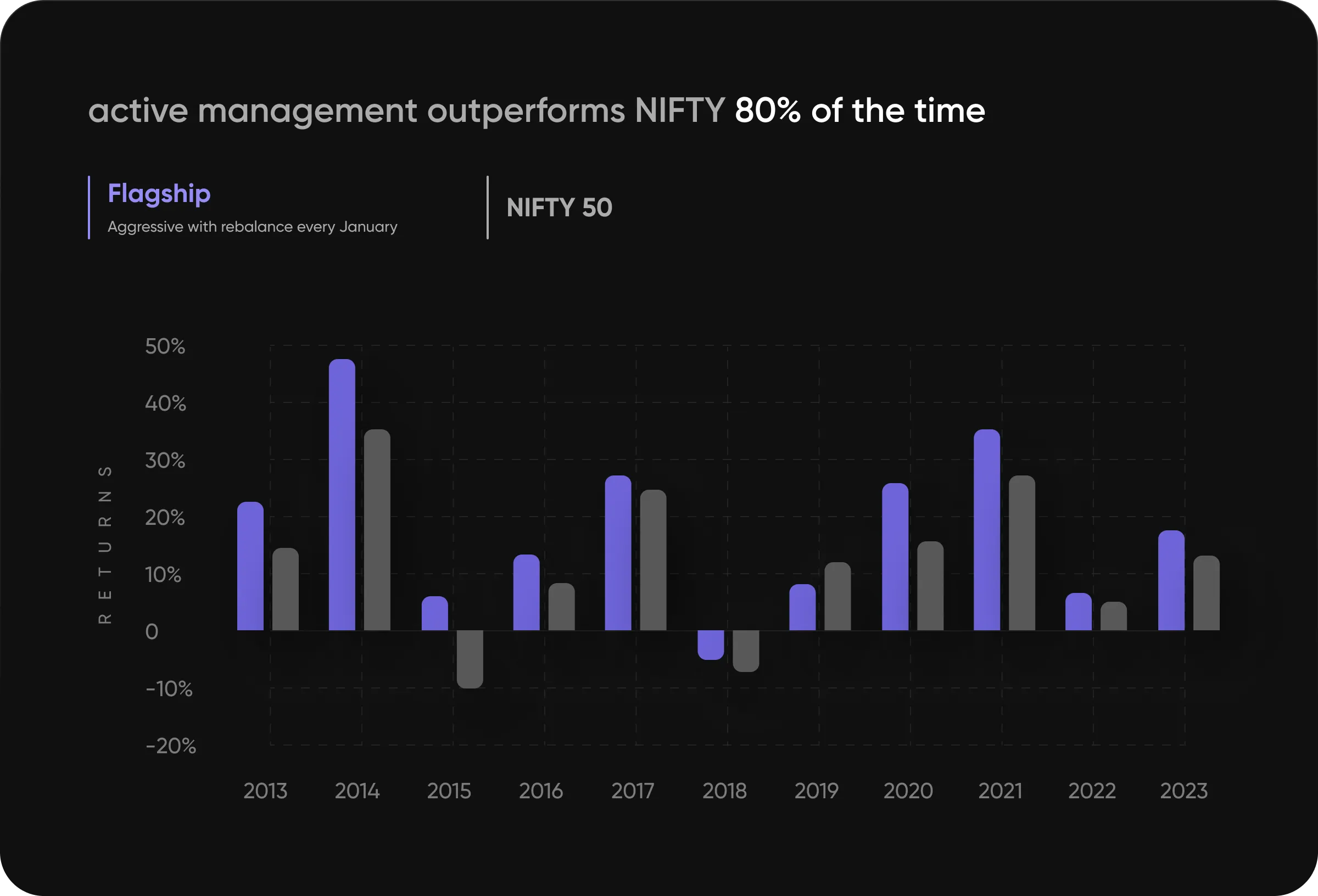

At Stack, we believe in actively managing your investments. Our Flagship Portfolio is a personalized approach that adjusts your asset allocation to maximize returns and align with your risk profile. This sets it apart from other portfolios that take a more passive approach. The Flagship Portfolio provides superior solutions for navigating market fluctuations and achieving your long-term financial goals.

the Flagship process

from coffee chat to portfolio generation

Our Flagship process begins with a personalised Coffee Chat session, where we engage in a brief conversation to understand your investing style, risk profile, and long-term financial goals. This crucial step helps us in customising the Flagship Portfolio according to your unique requirements.

the Flagship advantage

outperforming traditional investments

The Flagship Portfolio is carefully constructed to outperform traditional investment options such as fixed deposits (FDs), savings accounts, and other common avenues. By allocating funds to a combination of equities, debt instruments, and precious metals, the Flagship Portfolio aims to deliver superior returns while managing risk effectively.

introducing CASPeR

the Smart Stack Approach™️ to investing

We use a proprietary framework called CASPeR to help investors choose the best mutual funds for their portfolios. CASPeR is built on five pillars - Consistency, Attribution, Stability, Portfolio Efficiency & Investor Friendliness, and Risk.

the Flagship promise

safety and relative stability

The Flagship Portfolio emphasizes risk management and offers relative safety compared to individual stock investments, cryptocurrencies, and non-fungible tokens (NFTs). It provides investors with a disciplined approach to wealth creation, considering their risk appetite and long-term financial objectives.

Investing in individual stocks carries inherent risks, including the potential for capital loss. Studies have shown that a significant percentage of individual stock investments under-perform market benchmarks.

For example, research indicates that approximately 70% of actively managed equity funds fail to beat their respective benchmarks over 10 years (Source: S&P Indices Versus Active Funds Scorecard). The Flagship Portfolio, with its diversified approach and active management strategies, aims to mitigate such risks and increase the likelihood of positive returns.

introducing CASPeR

high-return investments with a growing corpus

The Flagship Portfolio also offers the potential to access investment opportunities with higher minimum investment amounts, such as private equity and real estate, as your corpus grows over time. By consistently contributing to the Flagship Portfolio, investors can build a substantial corpus that opens doors to exclusive investment avenues and potentially higher returns.

The Flagship Portfolio from Stack stands as a powerful investment solution that outperforms traditional options like FDs, savings accounts, and other common avenues. By leveraging a strategic combination of equities, debt instruments, and precious metals, the Flagship Portfolio aims to provide superior returns while managing risk effectively. Additionally, its relative safety compared to individual stock investments, cryptocurrencies, and NFTs offers investors peace of mind in their long-term wealth creation journey. By building a significant corpus, investors can unlock high-return opportunities like private equity and real estate. Start your journey with the Flagship Portfolio today and pave the way for long-term financial success.

key facts

Debt - Low

Gold/Silver - Low

Debt - Balanced

Gold/Silver - Low

Debt - High

Gold/Silver - Low

- Growth & Capital Appreciation

- Wealth Accumulation

- Risk-Adjusted Returns

- Outperform FDs & Inflation

- Steady Returns

- Beat Inflation

Disclaimer: The data mentioned above are based on past performance and should not be considered a guarantee of future results.