Mutual Funds

Explore 5,000+ Mutual Funds with Stack Wealth

Explore 5,000+ Mutual Funds with Stack Wealth

22.7%

Average Returns

₹1000+ Cr

Wealth Managed

1 Lakh +

Investors

₹0

Hidden Charges

Explore Curated Mutual Funds

Types of Mutual Funds

Mutual funds come in a variety of types, each designed to meet the diverse needs and goals of investors. Whether you're looking for high growth potential, stable income, or a balanced approach, there's a mutual fund suited for you.

Equity Mutual Funds

Debt Mutual Funds

Hybrid Mutual Funds

Investors looking for long-term wealth growth often turn to equity mutual funds. These funds pool money from various investors and invest primarily in stocks, offering the potential for high returns. They come in different flavours, including large-cap, mid-cap, and small-cap funds, catering to various risk appetites.

Explore All Equity FundsPopular Equity Mutual Funds

What are Mutual Funds?

A mutual fund is an investment pool to which many investors contribute money. This pool is managed by a professional fund manager who uses the money to buy a diversified mix of assets like equity, debt, and/or gold. The fund's value is divided into shares, which investors own. The benefit of a mutual fund over stock investing is diversification, which reduces risk by spreading investments across various assets. Investors earn money if the fund's value increases but can also face losses if it decreases.

WEALTH MANAGER

Talk to Your Dedicated Wealth Manager

Our wealth team will get in touch with you to assist you in making better investing decisions.

Advantages of Investing in Mutual Funds with Stacks

Diversification

It pools money from several investors to invest the money in a diversified portfolio consisting of stocks, bonds, mutual funds etc. which helps spread the risk.

Liquidity

It can be accessed anytime and can be liquidated at any point in time which helps during emergencies.

Managed By Experts

Fund managers have expertise in selecting and monitoring investments. They use research, analysis, and market insights to make informed decisions.

Regulation & Transparency

It is regulated, providing investor protection, transparency, and a suitable risk mitigation framework.

Affordability

They have relatively low minimum investment requirements, which allows a broad income spectrum to invest without hesitation.

Convenience

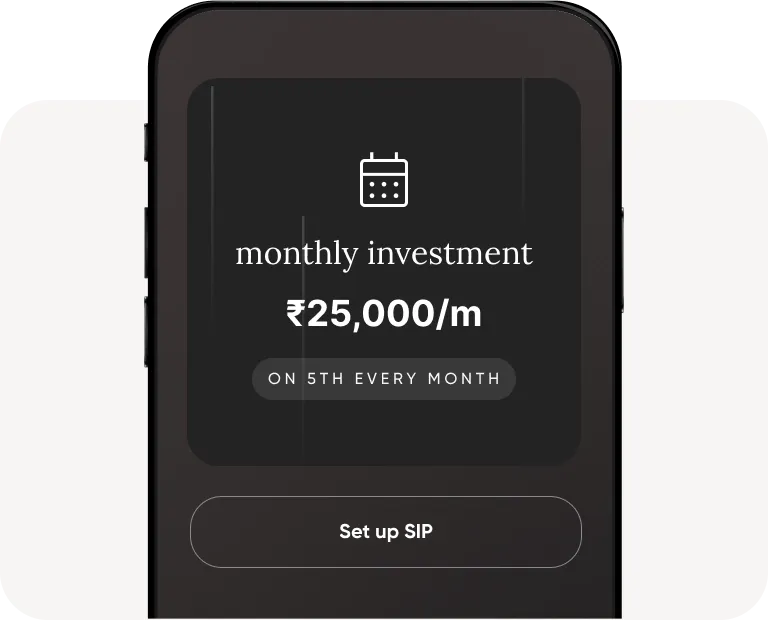

Investors can automate investments through SIPs, making it easier to contribute regularly without the need for active management.

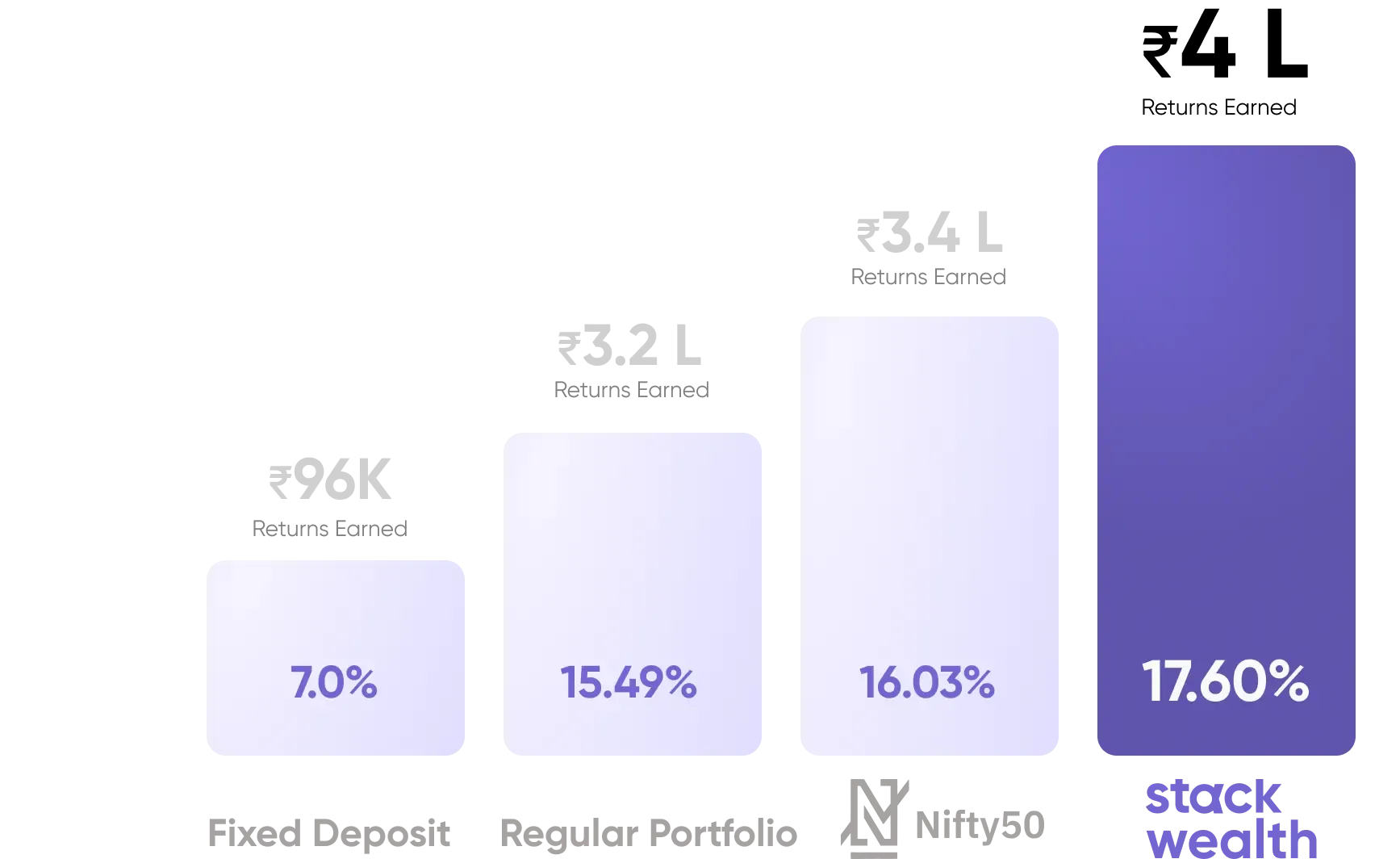

HIGH RETURNS

Multiply Your Returns By 3x with Stack Wealth

Stacks are an expert-curated list of mutual funds based on a specific strategy or sector.

Start Investing with Stack Wealth

STEP 1

Sign up & complete your KYC.

STEP 2

Tell us About Your Risk Level & Goals.

STEP 3

Start an SIP or One-time Investment.

Investing Made Simple

20 MinsMutual Funds

A Beginner's Guide to Mutual Funds in 2024

11 MinsSIPs

SIP vs. Lumpsum Mutual Fund Returns: Which is Better?

8 MinsSIPs

How SIPs Help You Beat the Market with Rupee Cost Averaging

TESTIMONIALS

Hear it from our valued customers

Our investment team will help you exit underperforming funds to earn higher returns.

View Testimonials21st July 2024

“At 56, All I Want is to Secure my Kids Future & Retire Soon. Stack Wealth Helped Me with that.”

At 56, all I want is to secure my kid's future & retire soon. Stack Wealth helped me with that.

Rajkumar

Marketing Manager

51.3% XIRR generated

15th September 2024

“With my Personalised Flagship Portfolio, I Know I’m Not Missing out on any Gains.”

With my Personalised Flagship Portfolio, I Know I’m Not Missing out on any Gains.

Kamal Jeet

Trader

25% XIRR in 3 Months

26th September 2024

“My Favourite Feature is Seeing the Best & Ideal Returns I can Earn with the Wealth Calculator feature.”

My favourite feature is seeing the best & ideal returns I can earn with the Wealth Calculator feature.

Shreyas D

Software Engineer

21% XIRR in 3 Months

1st September 2024

“My Portfolio Shot up by 20.2% in 2 Months! My Wealth Manager Helped me Pick the Right Funds.”

"My portfolio shot up by 20.2% in 2 months! My wealth manager helped me pick the right funds.”

Viplav Anand

Entrepreneur

159.2% XIRR Generated

21st July 2024

“At 56, All I Want is to Secure my Kids Future & Retire Soon. Stack Wealth Helped Me with that.”

At 56, all I want is to secure my kid's future & retire soon. Stack Wealth helped me with that.

Rajkumar

Marketing Manager

51.3% XIRR generated

15th September 2024

“With my Personalised Flagship Portfolio, I Know I’m Not Missing out on any Gains.”

With my Personalised Flagship Portfolio, I Know I’m Not Missing out on any Gains.

Kamal Jeet

Trader

25% XIRR in 3 Months

26th September 2024

“My Favourite Feature is Seeing the Best & Ideal Returns I can Earn with the Wealth Calculator feature.”

My favourite feature is seeing the best & ideal returns I can earn with the Wealth Calculator feature.

Shreyas D

Software Engineer

21% XIRR in 3 Months

1st September 2024

“My Portfolio Shot up by 20.2% in 2 Months! My Wealth Manager Helped me Pick the Right Funds.”

"My portfolio shot up by 20.2% in 2 months! My wealth manager helped me pick the right funds.”

Viplav Anand

Entrepreneur

159.2% XIRR Generated

Disclaimer: XIRR values are based on individual client investment horizons and returns over a few months. These values are not indicative of future returns.Investments are subject to market risks