Stacks: Expert-Created Mutual Funds

Discover expertly curated investment portfolios that align perfectly with your financial goals. Whether you're aiming to save on taxes, achieve high returns, or diversify your investments, Stack Wealth offers personalised solutions tailored to meet your unique needs. Our customised mutual fund portfolios provide an optimal mix of growth, income, and stability, ensuring that your wealth is managed precisely. With Stacks, you gain access to professional wealth management strategies designed to maximise your potential—giving you the confidence to invest wisely based on your goals and risk preferences.

What are Stacks?

Stacks are personalised, professionally managed mutual fund portfolios crafted by our wealth experts to fit different financial objectives. They combine mutual funds, asset classes, and sectors, offering a diversified investment approach. Each Stack is designed to match specific investment goals: wealth creation, tax savings, or risk management. With Stack Wealth, you can access sophisticated investment strategies once reserved for high-net-worth individuals—now available to all investors.

Types of Stacks

Explore our eight expertly crafted Stacks, each designed to address specific investment goals and strategies. These personalised portfolios offer a well-balanced mix of asset classes, ensuring a diversified approach that aligns with your risk tolerance and growth expectations.

1. Tax Saving Stacks

Our Tax Saving Stacks invest in high-return ELSS (Equity Linked Savings Schemes) funds that allow you to save up to ₹46,800 annually in taxes. These funds offer tax benefits under Section 80C and combine the potential for long-term equity growth. With a short lock-in period of three years, this Stack is perfect for those seeking disciplined investments with the dual benefits of wealth creation and tax savings.

2. High-Return Stacks

For investors looking for high-risk, high-reward opportunities, our High-Return Stacks are designed to deliver exceptional capital gains. These Stacks invest in aggressive growth-oriented mutual funds, some of which have historically delivered returns exceeding 60% in a year. These portfolios are ideal for investors with a higher risk appetite who aim to maximise their wealth over a short period.

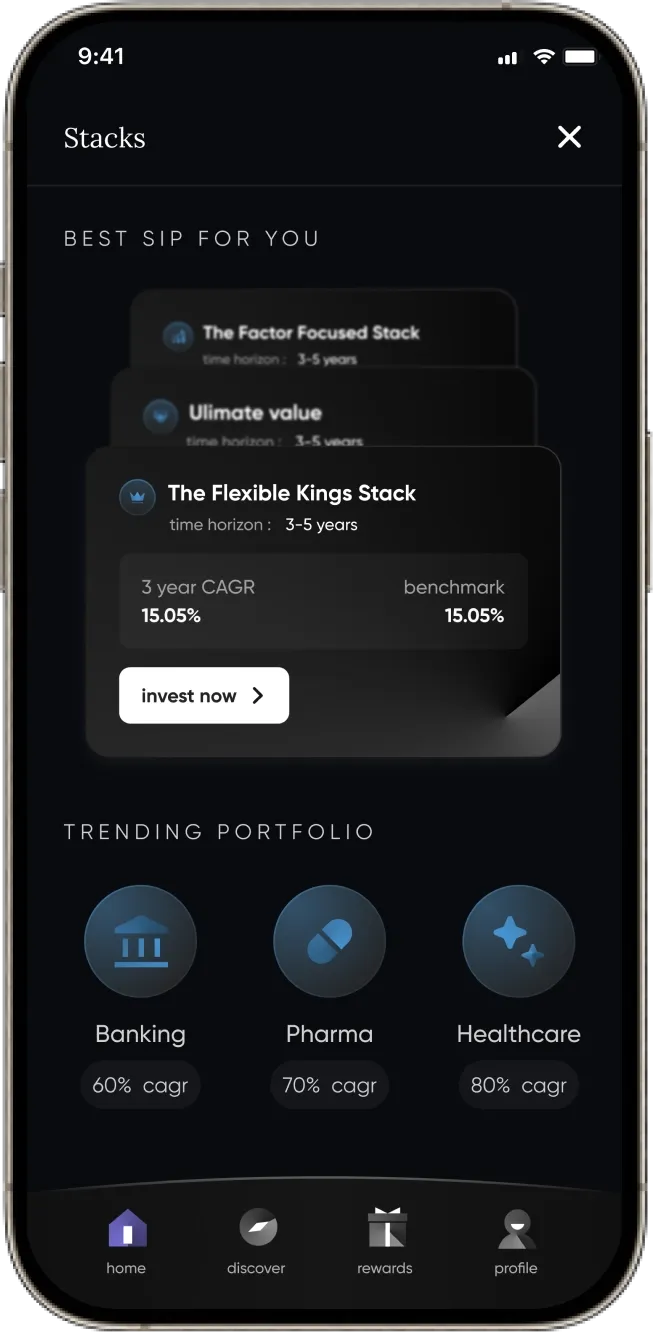

3. Thematic Stacks

Thematic Stacks focus on sector-specific investments in Banking, Pharma, FMCG, Tech, and Defence. By concentrating on sectors poised for growth, these Stacks let you capitalise on emerging market opportunities and macroeconomic trends. It is ideal for investors who want targeted exposure to industries with high growth potential.

4. Best in SIP Stacks

For those looking to build wealth systematically, our Best in SIP Stacks are designed for long-term growth. These Stacks invest in large-cap, mid-cap, Flexicap, and index funds, making them perfect for systematic investment plans (SIPs). With a balanced portfolio, you can enjoy consistent growth and minimise market volatility.

5. Fixed Income Stacks

If you’re a conservative investor looking for stability, our Fixed Income Stacks invest in top-performing debt mutual funds. These portfolios focus on capital preservation while generating steady, inflation-beating returns. Ideal for investors who want low-risk, reliable returns without the stock market's volatility.

6. Best Hybrid Mutual Fund Stacks

Our Best Hybrid Mutual Fund Stacks offer a blend of equity and debt investments, providing the best of both worlds—growth and income generation. These Stacks aim to capture market upside while providing portfolio stability, making them perfect for investors seeking a balanced approach to risk and reward.

7. Index Investing Stacks

With our Index Investing Stacks, you can mirror the performance of critical market indices like Nifty 50 and Nifty Alpha Low Volatility 30. These Stacks provide low-cost, diversified exposure to the broader market, ensuring that your returns align with market trends. Ideal for investors who prefer a passive investment strategy.

8. Gold Mutual Fund Stacks

Protect your wealth from inflation with our Gold Mutual Fund Stacks, which offer exposure to gold bullion with 99.5% purity. These Stacks are a reliable hedge against market volatility and currency devaluation, making them perfect for risk-averse investors seeking long-term security.

How Our Wealth Experts Create Stacks?

Our wealth experts use in-depth research and data-driven insights to create Stacks. The process begins by analysing market trends, sector performance, and macroeconomic factors to identify the best-performing mutual funds. We combine funds from various asset classes, equity, debt, and gold, to ensure diversification and risk management. Each Stack is designed to cater to specific investor goals, from high growth to capital preservation, ensuring you get a portfolio matching your financial objectives.

Why Invest in Stacks?

Investing in Stacks offers numerous benefits tailored to today’s market challenges:

- Personalised Wealth Management: Get access to curated portfolios designed to meet your financial goals.

- Diversification: Our Stacks provide broad exposure to multiple asset classes, reducing risk and enhancing returns.

- Expert Management: Every Stack is crafted by wealth professionals who leverage years of experience to make informed investment decisions.

- Flexibility: Adjust your portfolio anytime based on changing financial needs or market conditions.

Advantages of Investing in Stacks

- Tax Efficiency: With Tax Saving Stacks, you can reduce your taxable income while growing your wealth.

- Steady Returns: Fixed Income Stacks ensure consistent returns, which is ideal for conservative investors.

- High Growth Potential: High-return stacks offer significant capital appreciation opportunities for aggressive investors.

- Sector-Specific Exposure: Thematic Stacks allow you to tap into emerging sectors with high growth potential.

Who Should Invest in Stacks?

Stacks are ideal for all types of investors:

- New Investors: For a balanced, low-risk approach, beginners can start with Tax Saving Stacks or Best in SIP Stacks.

- Aggressive Investors: Those seeking higher returns can opt for High-Return Stacks or Thematic Stacks.

- Conservative Investors: If you prefer low-risk investments with consistent returns, Fixed Income Stacks or Gold Mutual Fund Stacks are ideal choices.

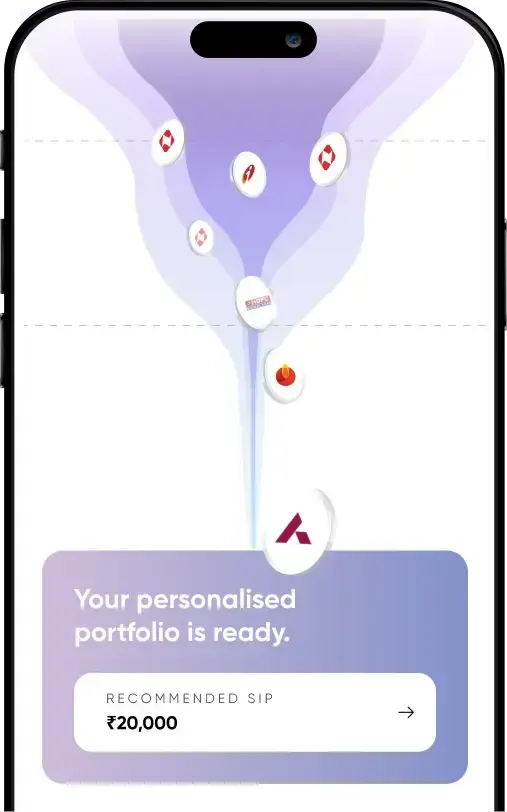

How to Invest in Stacks?

Investing in Stacks is simple and hassle-free. Follow these steps:

- Select Your Stack: Choose the Stack that aligns with your financial goals and risk appetite.

- Invest Online: Use our seamless online platform to invest in the Stack of your choice.

- Track Your Portfolio: Monitor your performance regularly and adjust as needed.

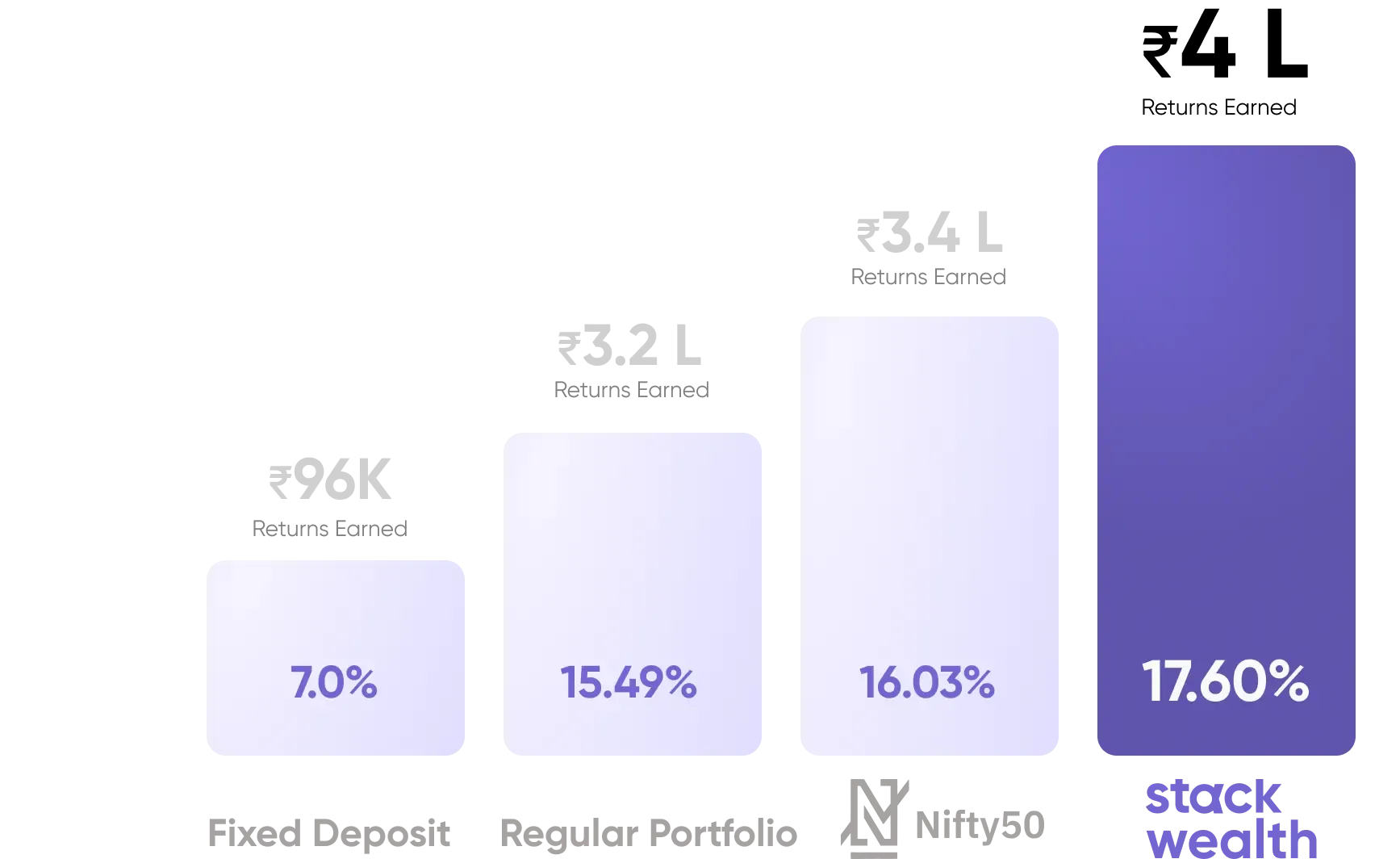

How Stacks Help You Get High Returns

By leveraging expert insights, diversification, and strategic asset allocation, Stacks maximise your returns while minimising risk. Our High-Return Stacks and Thematic Stacks are designed to capture growth in emerging sectors, while our Best in SIP Stacks ensure consistent long-term wealth creation.

Investing in Stacks with Stack Wealth gives you access to expert-managed, diversified mutual fund portfolios that cater to your financial goals. Whether you're looking to save on taxes, generate higher returns, or secure your wealth with low-risk investments, our Stacks provide a customised, efficient path to wealth creation.