Technology Mutual Funds

Sectoral-Technology Mutual Funds are a specialised category of mutual funds focusing exclusively on technology-based companies. These funds invest in sectors like IT services, software, hardware, cloud computing, and artificial intelligence, capitalising on the growth potential of tech companies. Investors seeking high growth often turn to these funds, but they should also be aware of the risks, as the technology sector can be volatile.

What is a Sectoral-Technology Mutual Fund?

A Sectoral-Technology Mutual Fund invests primarily in technology companies. These funds concentrate their assets in tech-driven sectors like IT, electronics, semiconductors, and communication services. The fund's portfolio typically includes stocks from companies like Infosys, TCS, and HCL in India or global giants like Apple, Microsoft, and Alphabet. By targeting tech sectors, these funds aim to deliver higher returns in exchange for higher risks due to sector concentration.

Features of Sectoral-Technology Mutual Funds

- These funds focus exclusively on technology and related sectors, providing exposure to domestic and international tech companies.

- The technology sector often grows faster than other sectors, offering the potential for higher returns.

- Due to their concentrated investment in a single sector, these funds are more volatile and prone to fluctuations than diversified funds.

- Fund managers strategically allocate assets to tech companies with strong growth forecasts and market leadership.

- Many of these funds invest in Indian and global technology companies, offering international diversification.

List of Top Technology Mutual Fund Schemes

Here are some of the top-performing technology mutual fund schemes:

How to Invest in Sectoral-Technology Mutual Funds

Investing in Sectoral-Technology Mutual Funds is simple and can be done through:

- Direct Mutual Fund Platforms: Investors can visit fund houses like ICICI or SBI to invest directly in their technology mutual funds.

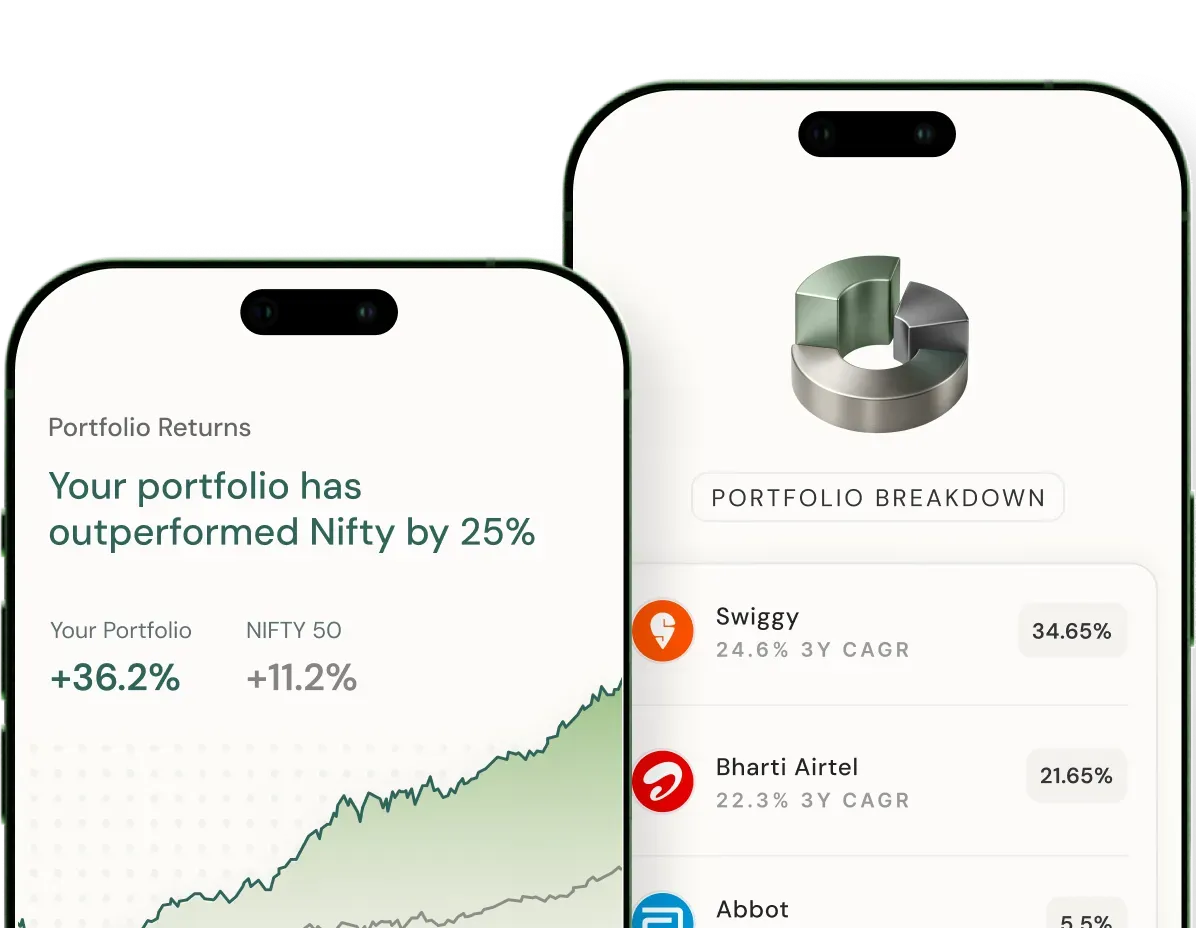

- Online Platforms: Stack Wealth offers various mutual funds, including technology sectoral funds.

- Through Financial Advisors: Investors who prefer professional guidance can consult financial advisors to invest in these funds.

Review the fund’s historical performance, expense ratio, and risk profile before investing.

Who Should Invest in Sectoral-Technology Mutual Funds?

- Risk-Tolerant Investors: These funds should be considered by individuals willing to accept higher risks in exchange for potentially higher returns.

- Long-Term Investors: Sectoral-Technology Funds are best suited for long-term investors looking to capitalise on the technological advancements that drive market growth over time.

- Tech Enthusiasts: Investors with a deep understanding of the technology sector may find these funds aligned with their knowledge and interests.

- Diversification Seekers: These funds can benefit those looking to add a high-growth, sector-specific asset to diversify their portfolio.

Limitations of Investing in Sectoral-Technology Mutual Funds

- High Volatility: Tech stocks react strongly to market conditions, regulatory changes, and innovation cycles.

- Sectoral Concentration: The narrow focus on technology makes these funds vulnerable to sector-specific downturns, unlike diversified funds that spread risk across multiple sectors.

- Cyclical Risks: Technology is a cyclical sector, meaning there are periods of boom and bust depending on economic factors and the pace of innovation.

Higher Expense Ratios: Sectoral funds may have higher management fees due to the specialised expertise required to manage these portfolios.