Table of Contents

View All ![]()

View All ![]()

What is Volatility?

What is Volatility in the Stock Market?

How is Volatility Calculated?

What Causes Volatility?

Types of Volatility

How to Manage Volatility?

Why are Portfolio Management Services Important?

How to Choose the Right Portfolio Management Service?

Conclusion

Exploring the stock market can be challenging, especially during volatile times when prices swing unpredictably. Understanding market volatility, its causes, and how to manage it is crucial for making informed investment decisions. In this blog, we’ll explore what volatility is, how it’s calculated, and its impact on the stock market, particularly in the Indian market. We’ll also discuss strategies to manage volatility and the benefits of using Portfolio Management Services (PMS) to safeguard your investments.

Volatility refers to the degree of variation in the price of a financial instrument over time. It is a statistical measure of the dispersion of returns for a given security or market index and is often used to quantify the risk associated with a particular investment. Higher volatility indicates a higher degree of risk, as prices can change dramatically over a short period in either direction.

Volatility in the stock market represents the rate at which the price of stocks increases or decreases for a given set of returns. A stock with high volatility is likely to experience sharp and unpredictable price changes, while a stock with low volatility typically experiences more stable and predictable price movements.

Take the Indian stock market during the COVID-19 pandemic as an example. The BSE Sensex, a primary stock market index in India, saw big ups and downs. From January to March 2020, the Sensex dropped by over 30%. But then, it bounced back quickly in the following months. This shows how the market was very volatile during that time.

Volatility is usually calculated using statistical methods such as standard deviation or variance. Here are the common methods:

Historical Volatility measures a stock’s past price fluctuations over a specific period. It is typically calculated as the standard deviation of daily returns.

Implied Volatility is derived from the market price of a market-traded derivative (usually an option) and represents the market’s expectation of future volatility.

To illustrate, if a stock’s returns over the past month have a high standard deviation, it is said to have high historical volatility. Conversely, if the market expects significant future price swings (implied by high option prices), the stock has high implied volatility.

Several factors can cause volatility in the stock market, including:

Economic Data: Reports on employment, inflation, and GDP can impact investor sentiment and cause price swings.

Political Events: Elections, government policies, and geopolitical tensions can lead to market uncertainty.

Corporate Performance: Earnings reports, mergers, and acquisitions can significantly affect stock prices.

Global Events: Natural disasters, pandemics, and other global crises can create market instability.

For example, the announcement of a government policy change, such as the demonetisation in India in 2016, led to immediate and significant volatility in the Indian stock market.

Volatility can be categorised into different types:

Historical Volatility

This is the actual volatility that has occurred in the past. It’s calculated using past prices of an asset. If you look at a stock’s price changes over the last year, you can determine its volatility. Historical volatility gives you an idea of how much the asset’s price has fluctuated previously.

Implied Volatility

Implied volatility is a forecast of how much volatility is expected. It’s not based on past prices but instead derived from the prices of options in the market. When traders think there will be significant price swings, implied volatility increases. When they expect stable prices, they go down. Implied volatility is crucial for options traders as it impacts the pricing of options contracts.

Market Volatility

Market volatility refers to the overall level of volatility in the entire market. It’s often measured by indices like the VIX (Volatility Index). When the VIX is high, the market is expected to be more volatile. Economic events, political news, or major financial decisions can influence this type of volatility.

Asset-Specific Volatility

This type of volatility examines the price fluctuations of a specific asset, such as a stock, bond, or commodity. For example, tech stocks might have higher asset-specific volatility than utility stocks because the tech industry is fast-changing and more unpredictable.

Currency Volatility

Currency volatility refers to changes in exchange rates between different currencies. This is crucial for businesses and investors involved in international trade. Interest rates, economic policies, and geopolitical events can influence currency volatility.

Interest Rate Volatility

This type of volatility focuses on changes in interest rates. It affects bonds and other fixed-income securities. When interest rates are expected to change frequently, the volatility of these financial products increases. Interest rate volatility is often linked to central bank monetary policy decisions.

Managing volatility involves strategies to mitigate risk and protect investments. Here are some methods:

Diversification: Spreading investments across various asset classes to reduce risk.

Hedging: Using financial instruments like options to offset potential losses.

Asset Allocation: Adjusting the proportion of different assets in a portfolio according to market conditions.

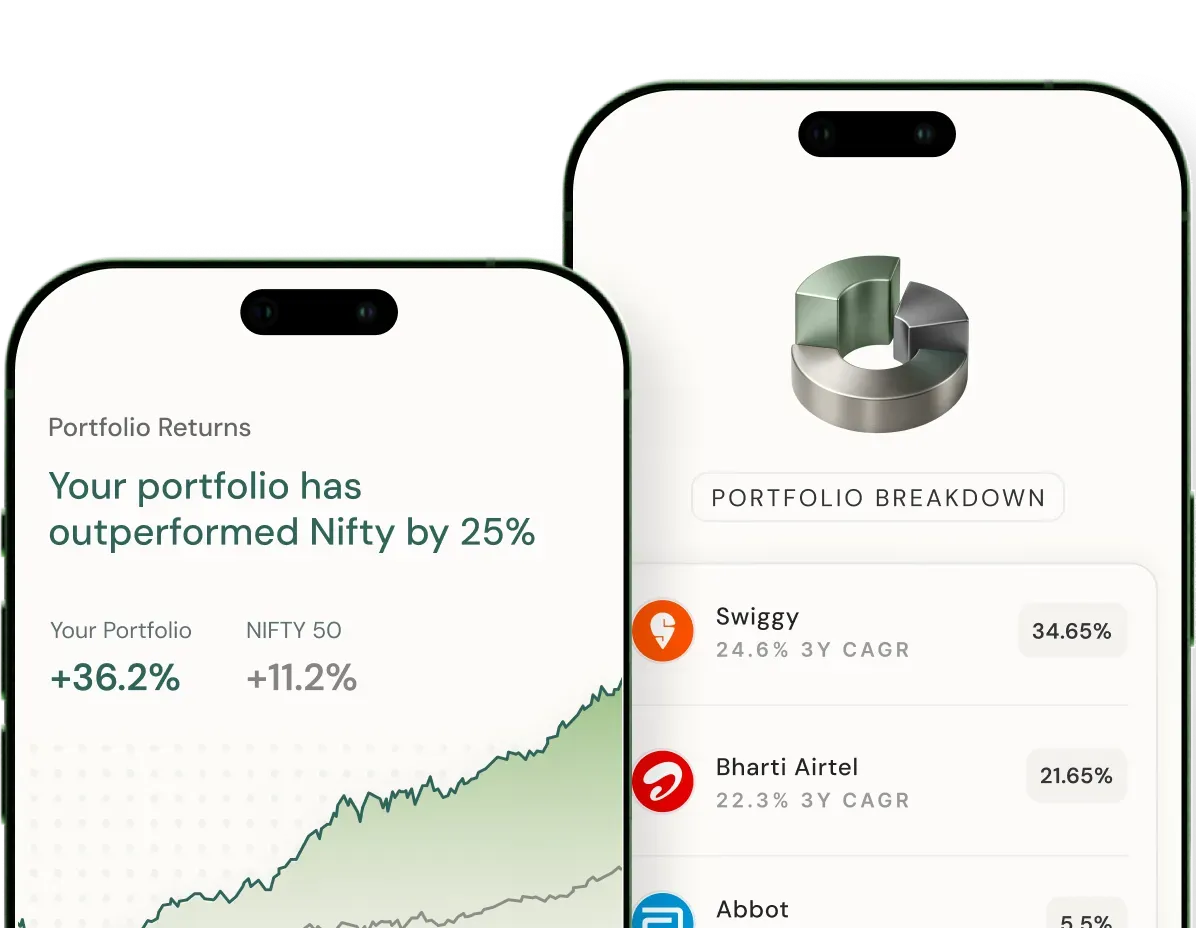

Portfolio Management Services (PMS) offer professional management of your investments, which is especially crucial during volatile times. Here are some benefits:

Expertise: Professional managers have the experience and knowledge to navigate turbulent markets.

Risk Management: PMS providers use sophisticated strategies to manage and mitigate risk.

Customisation: Portfolios are prepared concerning individual risk tolerance and investment goals.

Selecting the proper PMS is essential for effective volatility management. Here are some tips:

Track Record: Look for a PMS with a proven performance history, especially during volatile periods.

Transparency: Ensure the PMS provider offers clear and transparent reporting.

Fees: Consider the fee structure and ensure it aligns with the value provided.

Volatility is integral to the stock market, representing risk and opportunity. Understanding its causes, types, and management methods can help investors navigate turbulent times. Services like PMS can provide the expertise and strategies to handle market fluctuations effectively.

Understanding and managing volatility is crucial for successful investing, especially in a dynamic market like India’s. By staying informed and employing strategic measures, investors can confidently navigate volatility.

A seasoned investment professional with over 17 years of experience in AIF and PMS operations, investments, and research analysis. Abhishek holds an Executive MBA from the Faculty of Management Studies, University of Delhi, and has deep expertise in securities analysis, portfolio management, financial analytics, reporting and derivatives.

Disclaimer: This information is for general information purposes only. Investments in the securities market are subject to market risks, read all the related documents carefully before investing.

Impress your coworkers with your finance insights

20 MinsMutual Funds

A Beginner's Guide to Mutual Funds in 2024

8 MinsSIPs

How SIPs Help You Beat the Market with Rupee Cost Averaging

11 MinsSIPs

SIP vs. Lumpsum Mutual Fund Returns: Which is Better?

Scan this QR to download the App