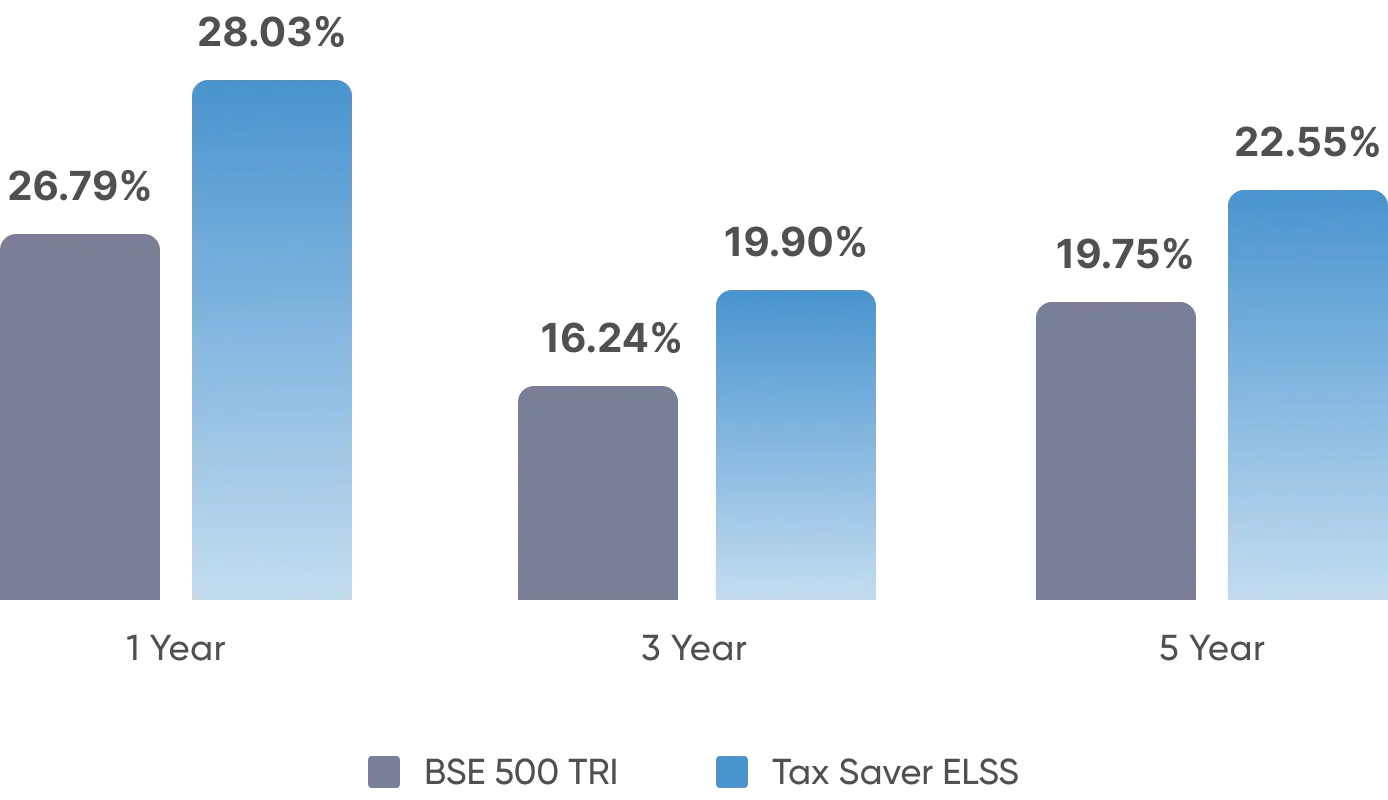

Save on paying taxes on your annual Income by investing up to ₹1,50,000/- annually in Equity Linked Saving Schemes (ELSS) / Tax Saver Funds. And while doing this, generate handsome long-term returns by staying invested for 3+ years.

What you are investing in

- Fundamentally strong companies with growth drivers in the medium to long-term

- Companies with solid management with an ability to capitalize on opportunities while managing risks

- A significant focus on firms with a track record of corporate governance, ESG sensitivity and transparency.

Investment strategy

1. Emphasis on Valuation for Safety

Prioritizing valuation methods to establish a prudent margin of safety in the investment process.

2. Holistic, Long-Term Stock Selection

Implementing a thorough valuation strategy that goes beyond traditional metrics, with a focus on selecting stocks for the long term.

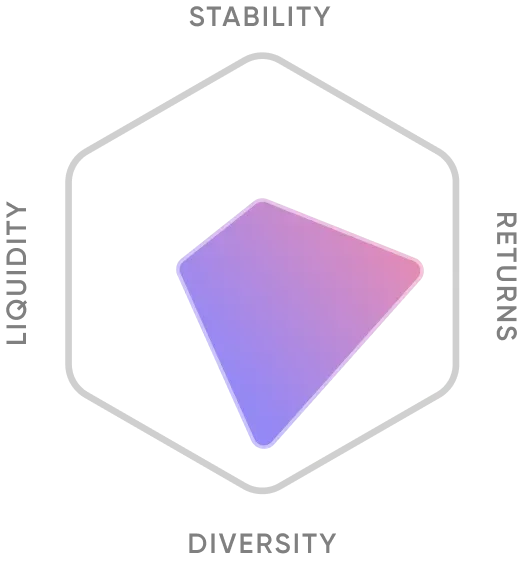

Pros & Cons of ELSS Tax Saver:

Who should invest in this

This portfolio is best suited for investors who are looking to avail benefits U/s 80C have a long investment horizon, are comfortable with some risk, and are looking to generate long-term returns.