As India grows from a $3 trillion economy to a $10 trillion economy, we aim to get invested in Companies that are building the necessary infrastructure such as Roads, Railways, Ports, Power, and more. These initiatives will improve connectivity and reduce logistics costs, making it easier for businesses to operate in the country. Participating and investing in India's growth story can lead to significant opportunities and returns for businesses and investors alike.

What you are investing in

- Companies engaged in the infrastructure theme: telecom, power, logistics, etc. across market caps.

- Government-focused projects: Railways, mining, defence, EPC, clean energy etc.

- Modern driving forces of capital expenditure like 5G, Data Centers, EV Charging infrastructures, coal gasification

- Real estate focused on affordable housing & defence companies with strategic partnerships.

Investment Strategy

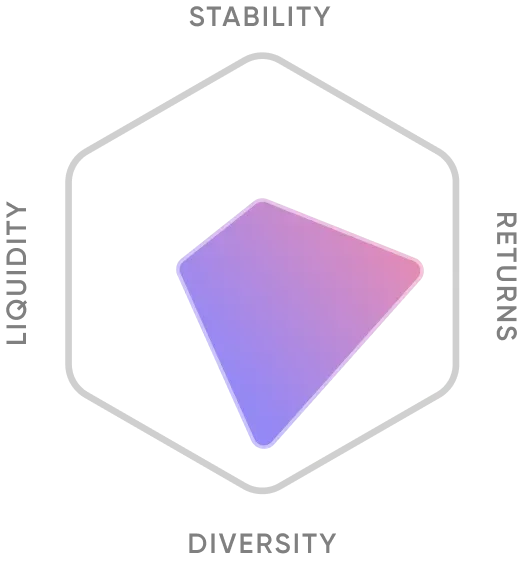

The Building India portfolio follows a flexi-cap investment strategy. A majority of its assets are allocated to equity and related securities in infrastructure sectors and a minority of its holdings in non-infrastructure stocks or debt. The approach aims to balance risk and return through thorough research, including top-down macro and bottom-up micro-analysis, with a counter-cyclical strategy to avoid overexposed sectors.

- A mix of top-down macro and bottom-up micro research to pick up stocks providing long-term potential.

- Blend investment across market caps, opportunistically investing outside benchmarks.

- Overweight exposure to the core sectors which can benefit from the revival of the capital cycle & economic reforms.

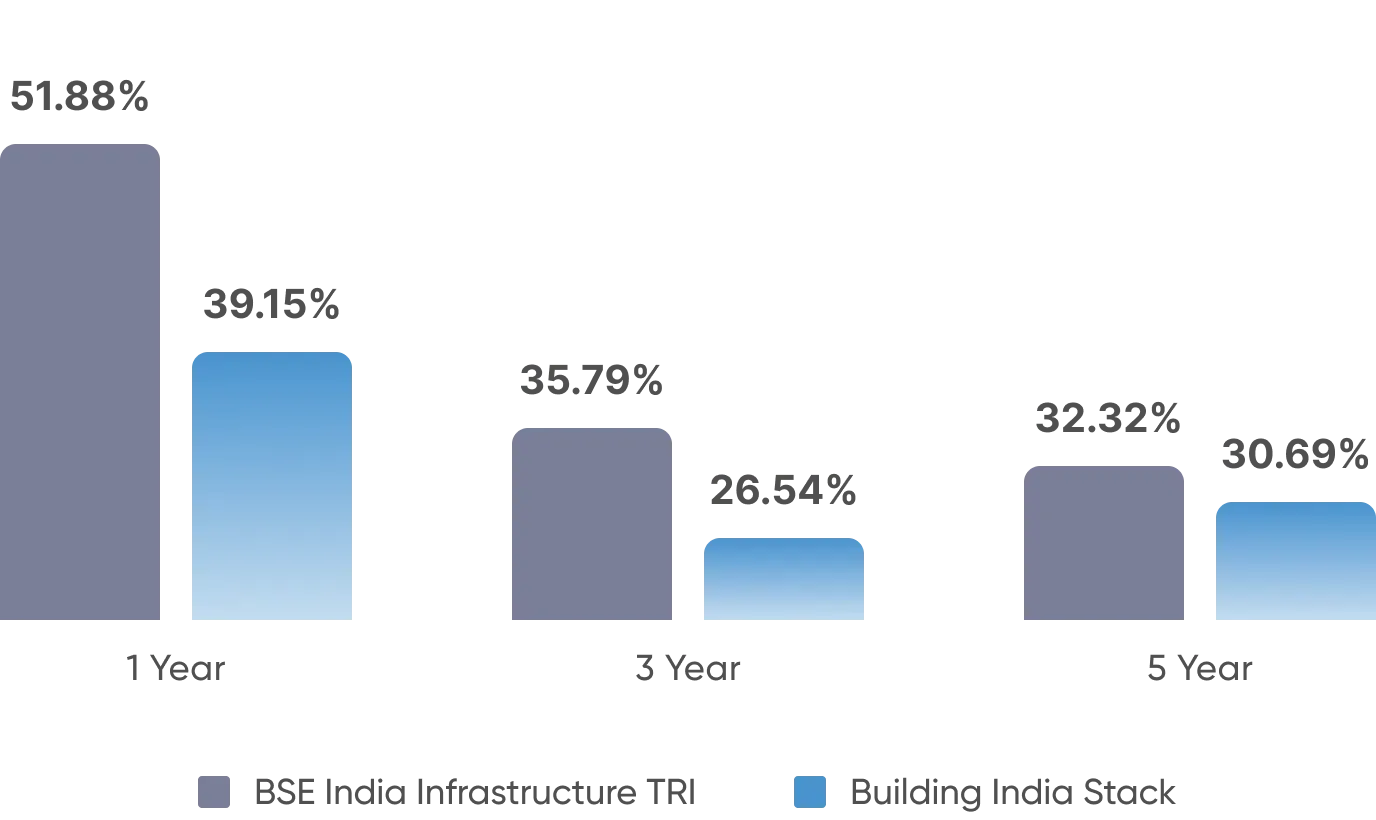

Historical Performance in Global Markets

Over the past 1, 3, and 5 years, most infrastructure-focused funds have outperformed benchmark indices. The fund is benchmarked against the Sensex and Nifty 50, which track the performance of the 30 largest and 50 largest companies listed on the BSE and NSE, respectively.

Pros & Cons of Building India Portfolio

Who Should Invest?

The Building India portfolio is suitable for investors who are looking to invest in India's growth story and who have a long-term investment horizon of at least 5 years. Some of the specific qualities that would make an investor a good fit for this portfolio are a long-term investment horizon, high-risk tolerance, appreciation for the Indian economy, and prioritisation of diversification. The portfolio is high-risk, as it invests in small-cap and mid-cap companies. However, it has the potential to generate high returns as the Indian economy grows with rising investments in critical infrastructure.