The Atmanirbhar Bharat initiative is a bold and ambitious plan to make India self-reliant in key sectors. It is a long-term strategy, but it has the potential to make a real difference in the Indian economy. The initiative is already starting to show some positive results. For example, the government has announced a number of measures to boost domestic manufacturing, and these measures have already led to an increase in investment and production. The government has also taken steps to reduce India's dependence on imports, and these steps are helping to save foreign exchange.

What you are investing in

- Predominantly equity and equity-related securities of companies engaged in manufacturing themes.

- Companies utilizing China +1 strategy and Production Linked Incentive schemes.

- Cyclical & defensive stocks depending on the current economic business cycle.

- Auto & auto ancillary, pharmaceutical & healthcare, capital goods, chemicals and metals

Investment Strategy

This portfolio invests in a variety of manufacturing sectors, including exports-oriented, domestic consumption, and domestic capital expenditure manufacturing. It is market-cap and sector-agnostic, meaning it can invest in small, medium, and large-cap companies. The portfolio may take aggressive positions in specific sub-themes of manufacturing, depending on the economic environment and the investment objectives.

- Manufacturing theme with a market-cap and sector-agnostic approach, diversified into subthemes of manufacturing

- Buy either the sector leaders or companies benefitting from the sectoral tailwinds during economic and business upcycle

- Invest in companies from sectors which provide lower downside risk during downcycles

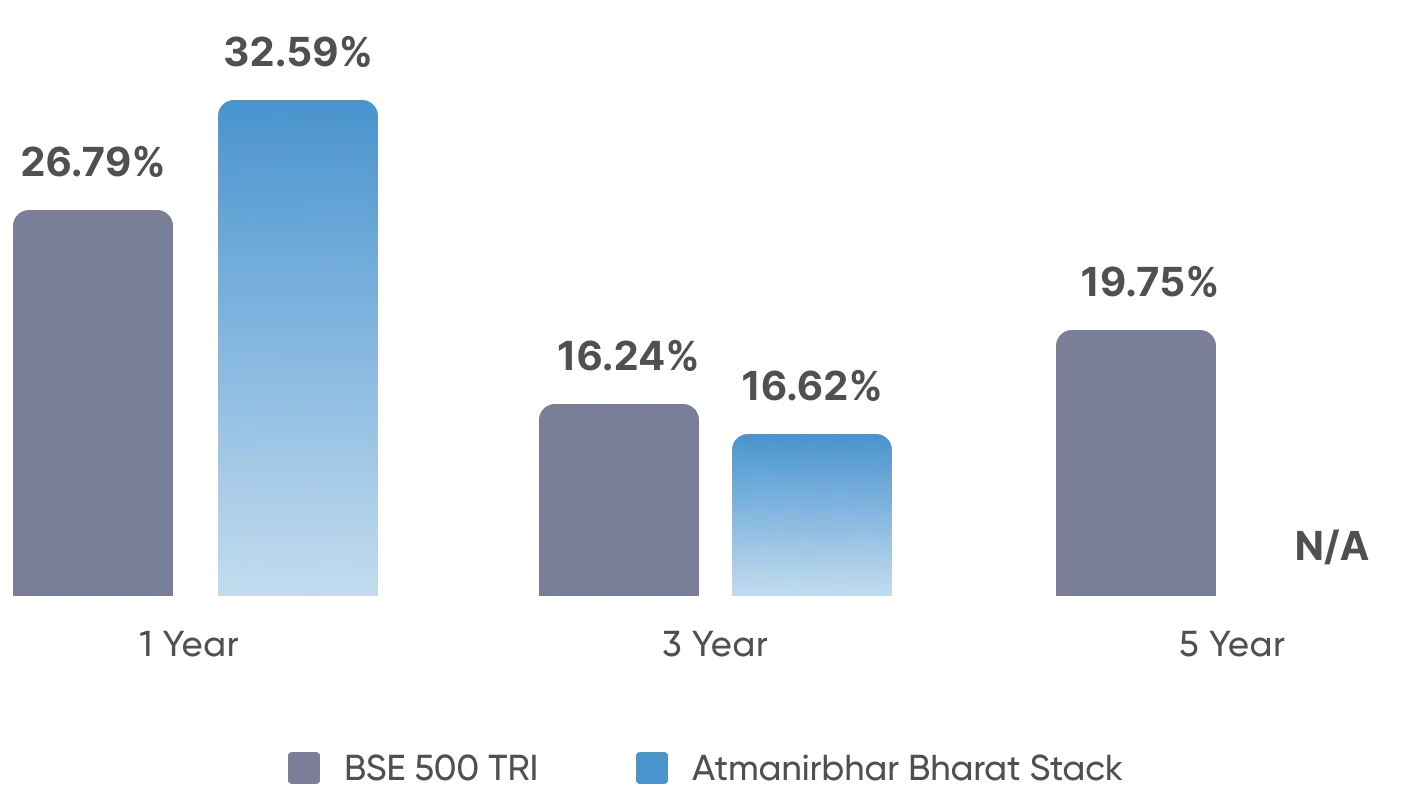

Historical Performance in Global Markets

Over the past 3 years, most manufacturing sector-focused funds have outperformed benchmark indices. The fund is benchmarked against the NIFTY India Manufacturing TRI.

Pros & Cons of Atmanirbhar Bharat

Who Should Invest in this?

The Atmanirbhar Bharat portfolio is a good investment for long-term investors who are looking to generate capital appreciation by investing in the manufacturing sector. The portfolio is diversified across a variety of manufacturing sectors and sub-themes, and it is managed by experienced professionals. The portfolio is designed for investors who are looking to invest for the long term, at least 5 years & is subject to market volatility, so investors should have a high-risk tolerance. Investors should have a basic understanding of the manufacturing sector and the factors that can affect its performance.