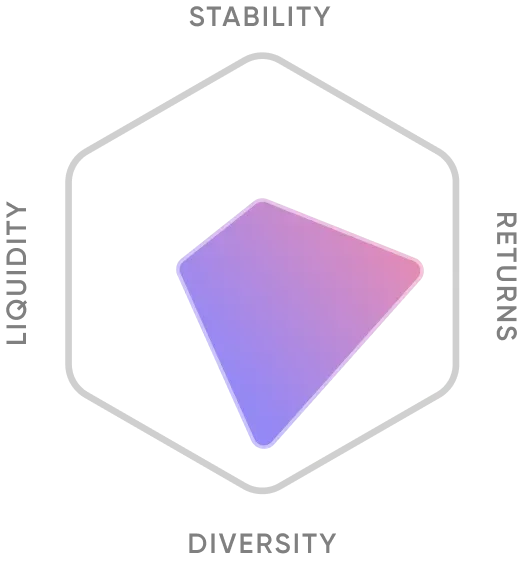

It is designed to cater to both conservative investors seeking stability and growth-focused investors aiming for capital appreciation. With exposure to dynamic sectors such as IT and pharma, alongside steady performers like consumer goods, this portfolio is ideal for those seeking a balanced, long-term wealth creation strategy.

What you are Investing in

- Exposure to innovative pharma and healthcare companies, benefiting from long-term growth trends.

- Focuses on tech sectors like AI and cloud computing, capitalizing on digital transformation.

- Invests in FMCG, offering stability through demand for essential products.

- Targets energy and renewable sectors, benefiting from global sustainability trends.

Why Golden Sectors

- Pharma and Healthcare

- Invests in pharma and healthcare companies to capitalize on long-term growth in medical advancements and aging populations.

- Technology

- Focuses on high-growth tech companies, particularly in AI, cloud computing, and digital transformation.

- Consumer Goods

- Targets stable, high-demand FMCG companies, benefiting from consistent consumer product demand.

- Natural Resources and New Energy

- Invests in energy, natural resources, and renewable energy sectors, aligning with global sustainability trends.

Pros & Cons of Golden Sectors

Who Should Invest

The Golden Sectors portfolio is ideal for investors seeking a mix of stability and growth. It suits both conservative individuals looking for risk mitigation and growth-focused investors aiming for long-term capital appreciation through exposure to dynamic and established sectors.