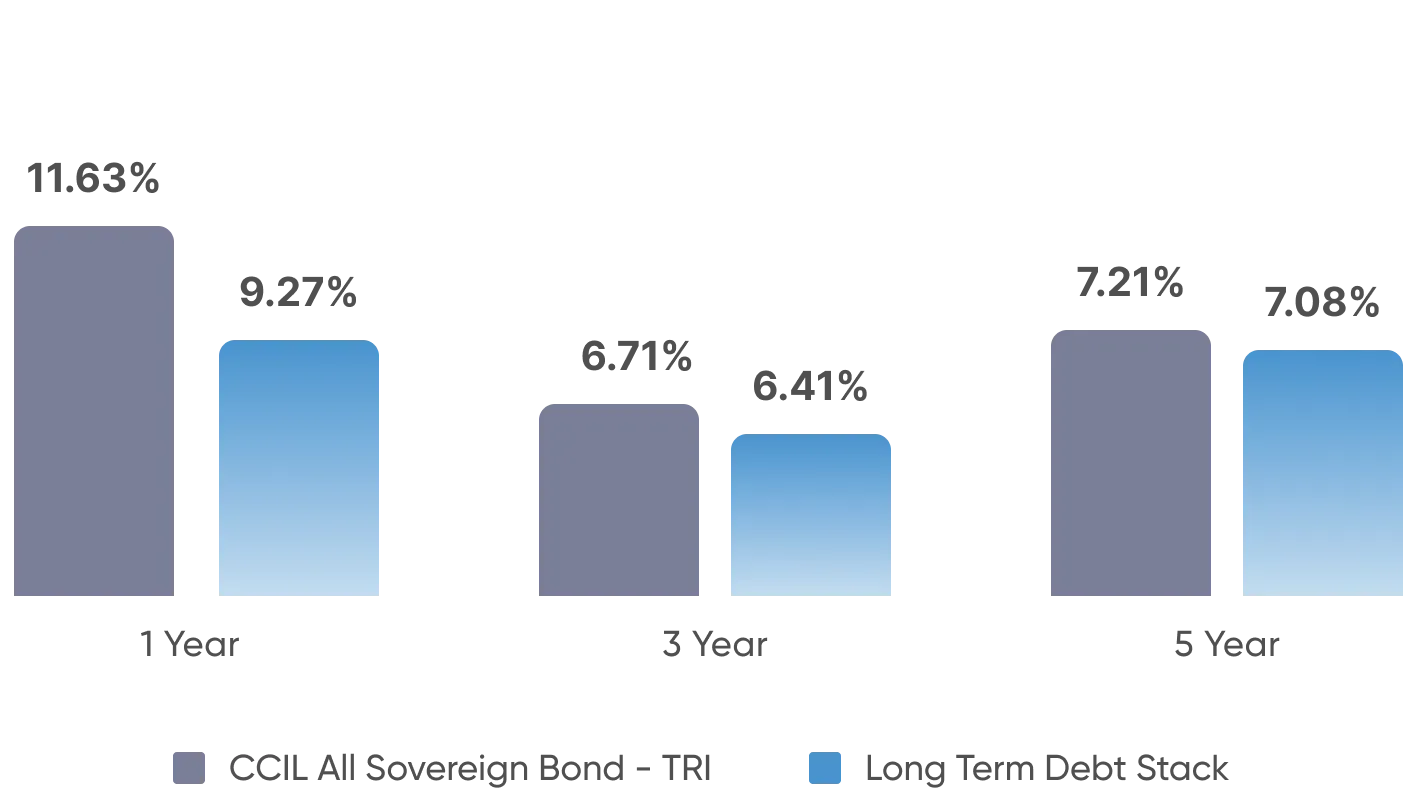

Long-Term Debt Opportunities invests in a basket of long-duration funds with high credit quality, largely sovereign-rated bonds, that will not only provide high interest rate yield but also an additional kicker in the form of capital appreciation in prices of bonds as interest rates in the economy fall.

What you are investing in

- Invest in government-backed high-quality long duration bonds

- Low credit default risk due to sovereign / AAA rating

- Additional kicker from price appreciation of bonds during falling interest rate regime.

Investment Strategy

Falling Interest Rates

Capitalize on declining interest rates by investing in long-dated G-Sectors for income and capital growth.

Maximizing Returns with Long-Term Debt

Leverage falling rates by buying long-maturity G-Secs, offering steady income and capital appreciation potential.

Pros & Cons of Long Term Debt Opportunities

Who Should Invest in this?

This portfolio is best suited for investors who have atleast a 1 year investment horizon, are comfortable with some volatility in portfolio returns, and are looking to generate substantial returns in the short to medium term. Retirees who are looking for a kicker in addition to a steady income stream without taking disproportionate risk may also be well-suited for this opportunity stack.