Pharma Edge invests in the healthcare sector, focusing on equity and equity-related securities of pharmaceutical and healthcare companies. The portfolio's goal is to consistently earn returns by taking advantage of the increasing demand for healthcare services at home and worldwide.

We have chosen funds that focus on the US healthcare market, which is influenced by patent expirations, leading to increased availability of generic drugs. The healthcare sector is also experiencing a shift towards cost-effectiveness, presenting opportunities for growth.

Furthermore, with nearly 50 drugs set to go off-patent, our portfolio is strategically positioned to benefit from the potential growth in the Indian generic drug market. Pharma Edge targets leading sectors and companies within the healthcare industry:

Sectors: Pharmaceuticals, biotech, healthcare services, insurance

Top Companies: Sun Pharmaceuticals, Cipla, IPCA, Lupin

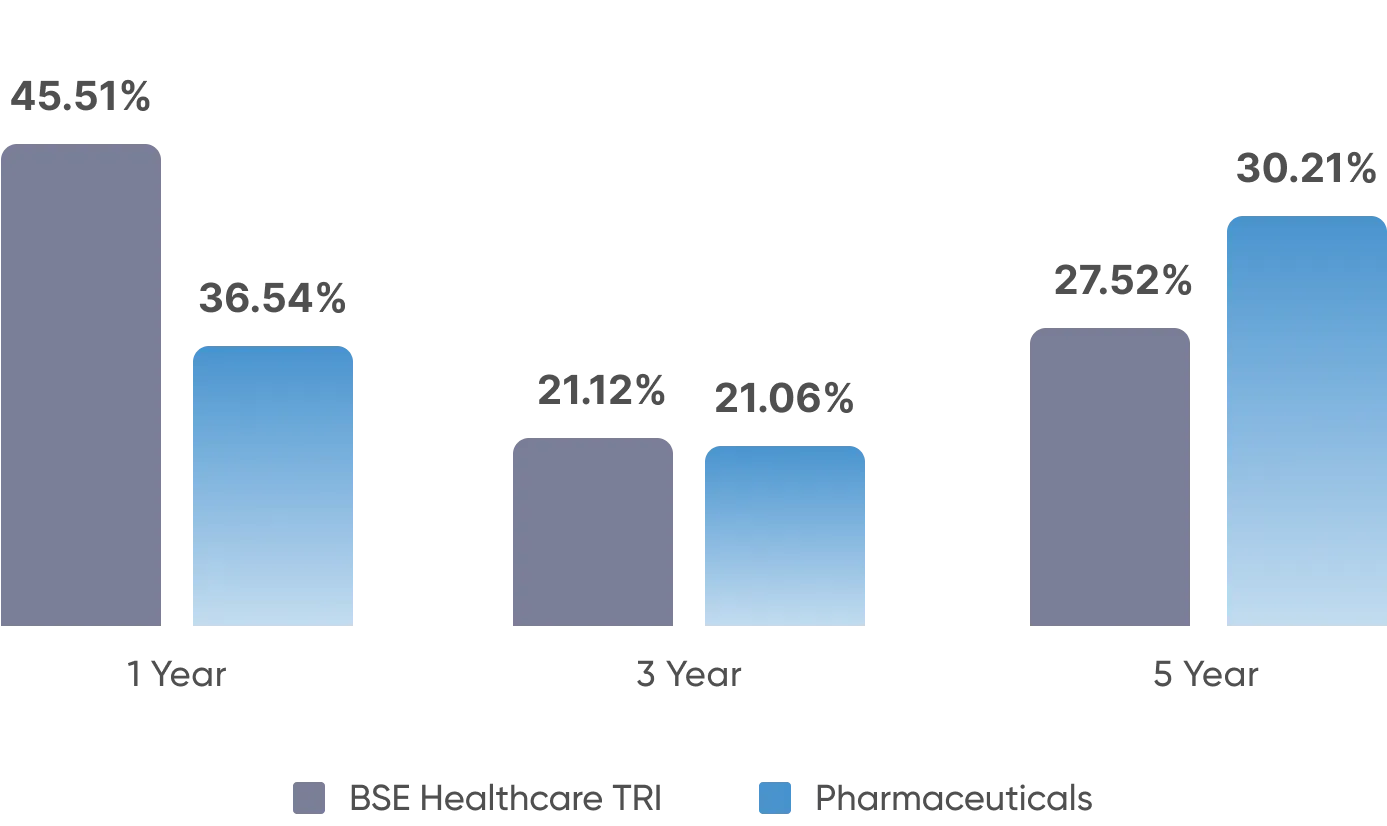

Annualized Past Returns

Pharma Edge has delivered impressive returns across various time horizons, reflecting its robust performance in the healthcare sector. Over the past year, the portfolio achieved the following returns:

Although these short-term returns slightly lag behind the benchmark, the portfolio's longer-term performance underscores its potential for sustained growth.

Who Should Invest in Pharma Edge?

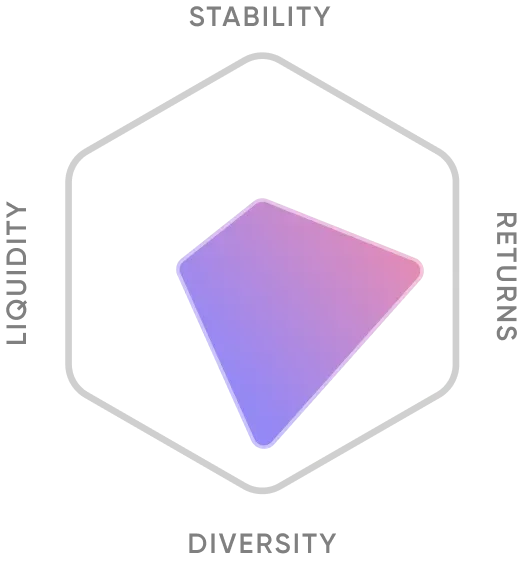

Pharma Edge is great for investors who want to mix things up by investing in various big, medium, and small-sized companies. These investors like to change up their investments based on how the market is doing and want to spread their money across different parts of the market with room to grow. This investment opportunity is aimed at people aged 18-50 and is considered to be on the riskier side. The financial goals for Pharma Edge include building wealth, diversifying assets, and planning for education.

Advantages of Pharma Edge

Let's take a closer look at the bright opportunities that Pharma Edge have:

Capitalizing on Rising Healthcare Demand

In India, sales of local medicine are going up because of programs like Ayushman Bharat and other things the government is doing.

Global Healthcare Markets

Including US healthcare stocks helps diversify the portfolio and reduce volatility due to the low correlation with the Indian healthcare market.

Future Growth Potential

Nearly 50 drugs are slated to go off-patent soon, presenting a significant opportunity for the Indian generic drug market. Pharma Edge is well-positioned to harness this potential.

Risks of Pharma Edge

Regulatory Impact

Government rules can really affect how much money healthcare companies make, which adds some risk.

Drug Development Failures

The risky nature of developing new drugs means that if clinical trials fail, the drug portfolio's performance can suffer.

Pharma Edge emerges as a compelling choice for investors seeking to capitalize on the dynamic growth of the healthcare industry. By strategically investing in top healthcare funds and leveraging opportunities in both local and global markets, this portfolio offers significant long-term growth potential, albeit with higher risks.

Pharma Edge presents an attractive investment opportunity for those willing to navigate market fluctuations for the possibility of substantial rewards and diversify their investments across the healthcare sector. Whether building wealth, diversifying assets, or planning for education, Pharma Edge aligns with the financial goals of investors seeking to harness the ever-expanding healthcare market's potential.

In summary, Pharma Edge offers a bold and strategic approach to healthcare investing aimed at those prepared to embrace risk in pursuit of substantial returns and long-term financial growth.