The All that Glitters portfolio is a good way to diversify your portfolio and gain exposure to precious metals. Gold and silver are often seen as safe-haven assets, and they can help to hedge against inflation and other risks. This portfolio can help to reduce your overall risk, as the two metals tend to have different price movements. The funds in this portfolio track the price of gold & silver and provide investors with a way to invest in gold without having to buy physical commodities.

What you are investing in

- Physical Silver and silver-related instruments.

- Commodities that provide diversification as their price movements are less correlated to equities.

- This portfolio aims to invest in 99.5% purity gold bullion.

- Precious commodities that enable investors to park their excess funds safely for long periods of time.

Investment strategy

This portfolio aims to serve as a hedge against inflation by incorporating the following investment strategy.

- Generate returns that are in line with the performance of physical silver & gold in domestic prices as derived from the LBMA AM fixing prices.

- Strategically diversify investments in gold & silver funds to diversify the portfolio.

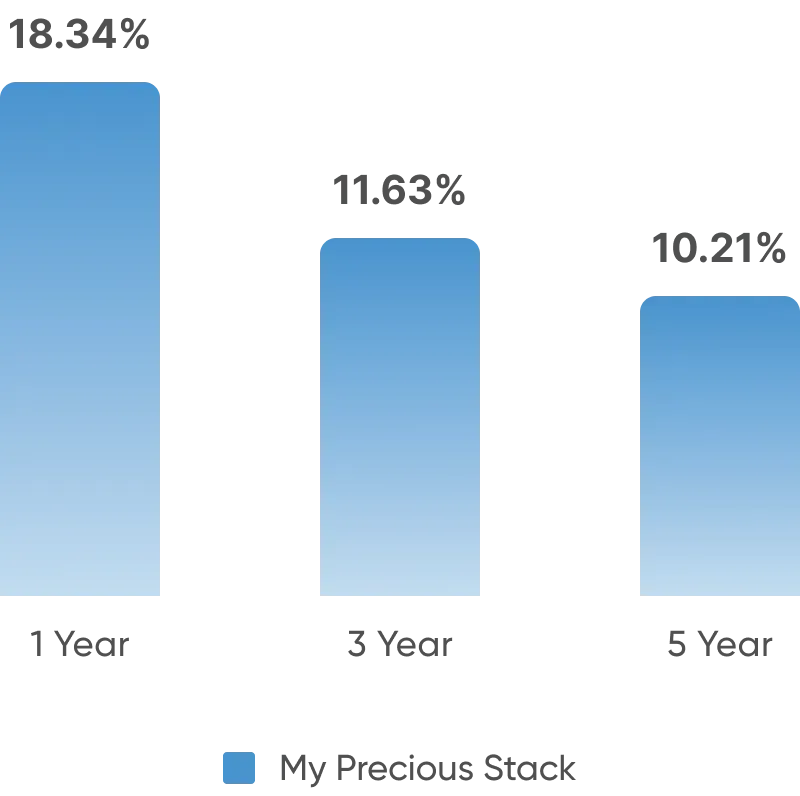

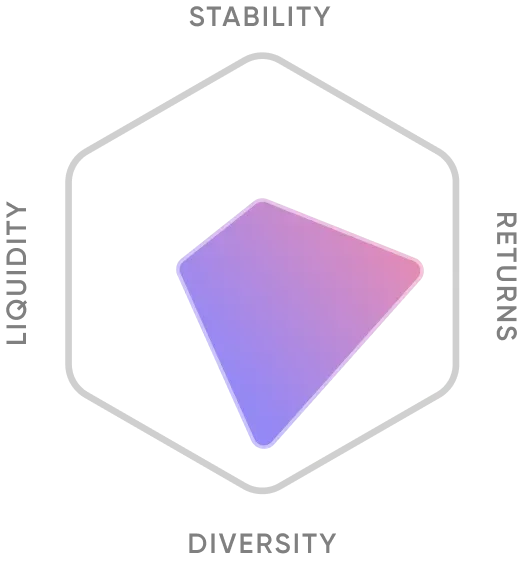

Pros & Cons of My Precious Stack

Who Should Invest in this

This type of portfolio is also a good option for investors who have a long-term investment horizon. Precious metals tend to generate lower returns than other asset classes, such as stocks and bonds, over the short term. However, they can perform well over the long term. This portfolio is a good option for investors who are looking to diversify their portfolios, hedge against inflation, and preserve their capital.