What you are investing in

- Invest in government-backed growth companies amid India's strong economy.

- Use funds focusing on sectors like Oil, Gas, Power for potential growth.

- Allocate some funds to government-related stocks, balance with others.

- Vary investments in size, safeguard against different risks.

The Ultimate Value portfolio follows an investment strategy based on the fact that the market is not always efficiently matching a stock’s price with its intrinsic value. Investment managers seek to benefit from this inefficiency in the market to generate reasonable returns.

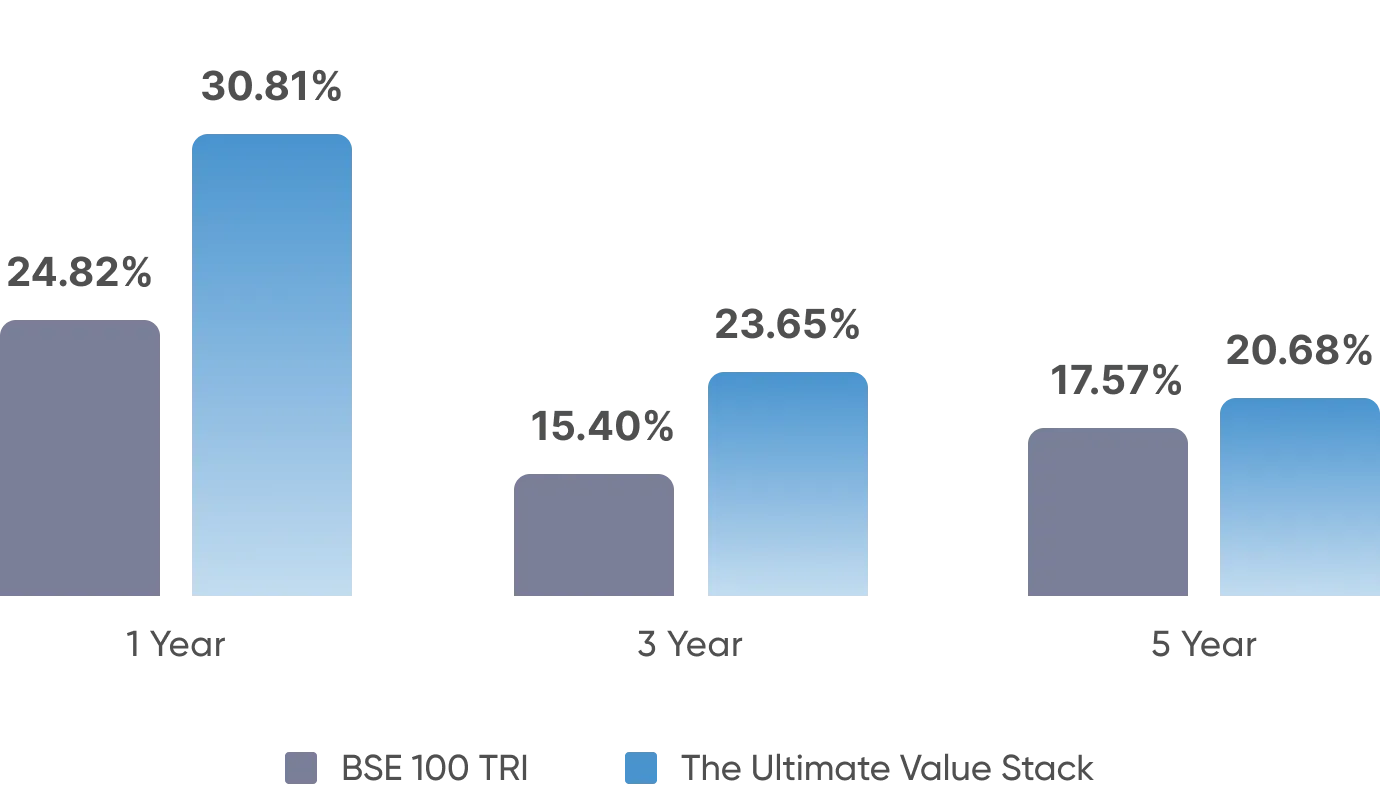

Historical Performance in Global Markets

In the American stock market, value stocks outperformed growth stocks (stocks expected to grow their earnings with business expansion) by an average of 2.5% per year over the period 1975-2020.

Since March 23, 2020, Nifty Value Index outperformed Nifty Growth Index by 33% indicating that value stocks performed better than growth stocks in recent years

Pros and Cons of Ultimate Value Stack

Who Should Invest in this

This portfolio is best suited for investors who have a long investment horizon, are comfortable with some risk, and are looking to generate long-term returns. Retirees who are looking for a steady income stream and investors who are willing to invest for at least five years may also be well-suited for value investing.