Factor investing involves selecting investments based on specific attributes (factors) that historically influence stock performance, such as value, growth, volatility, and momentum. Imagine you’re building a winning sports team. Instead of picking individual players, you choose certain qualities they possess, such as speed or skill. In finance, you pick stocks not based on the company, but on specific traits like low risk or high growth potential. This strategy aims to boost returns.

Investment strategy

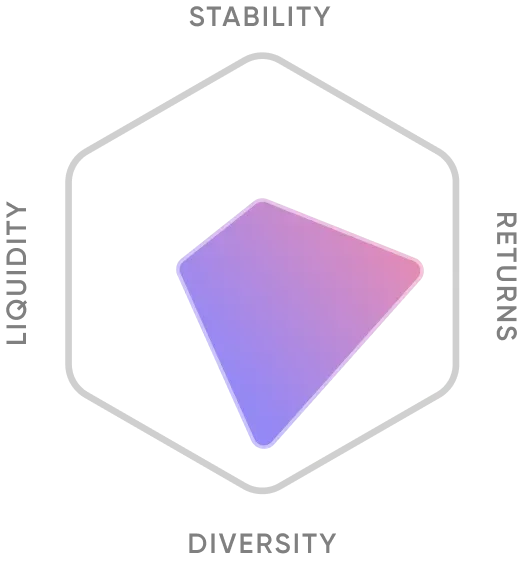

This portfolio combines two strategies to employ factor investing that focuses on specific factors like value, growth, and momentum to construct portfolios. It seeks to outperform the broader market by targeting these factors.

- Mirror the Nifty Alpha Low Volatility 30 Index by investing in diverse, low-volatility Nifty 100 stocks for stable returns with less price variation.

- Match the Nifty 50 Equal Weight TR Index by investing equally in its 50 stocks, aiming for similar index returns with even weight distribution.

What you are investing in

- Capture booming sectors like finance, healthcare, FMCG & automobiles.

- Invest in India's top 100 companies, each with the same weight in the portfolio.

- Indian companies with stable stock prices and potential for consistent returns.

- A well-diversified portfolio that avoids undue concentration in a few stocks/sectors.

Historical Performance in Global Markets

It is observed that factor strategies have a tendency to show healthy outperformance against Nifty 50 during periods when more stocks are outperforming the benchmark index.

Pros & Cons of Factor Focused Investing

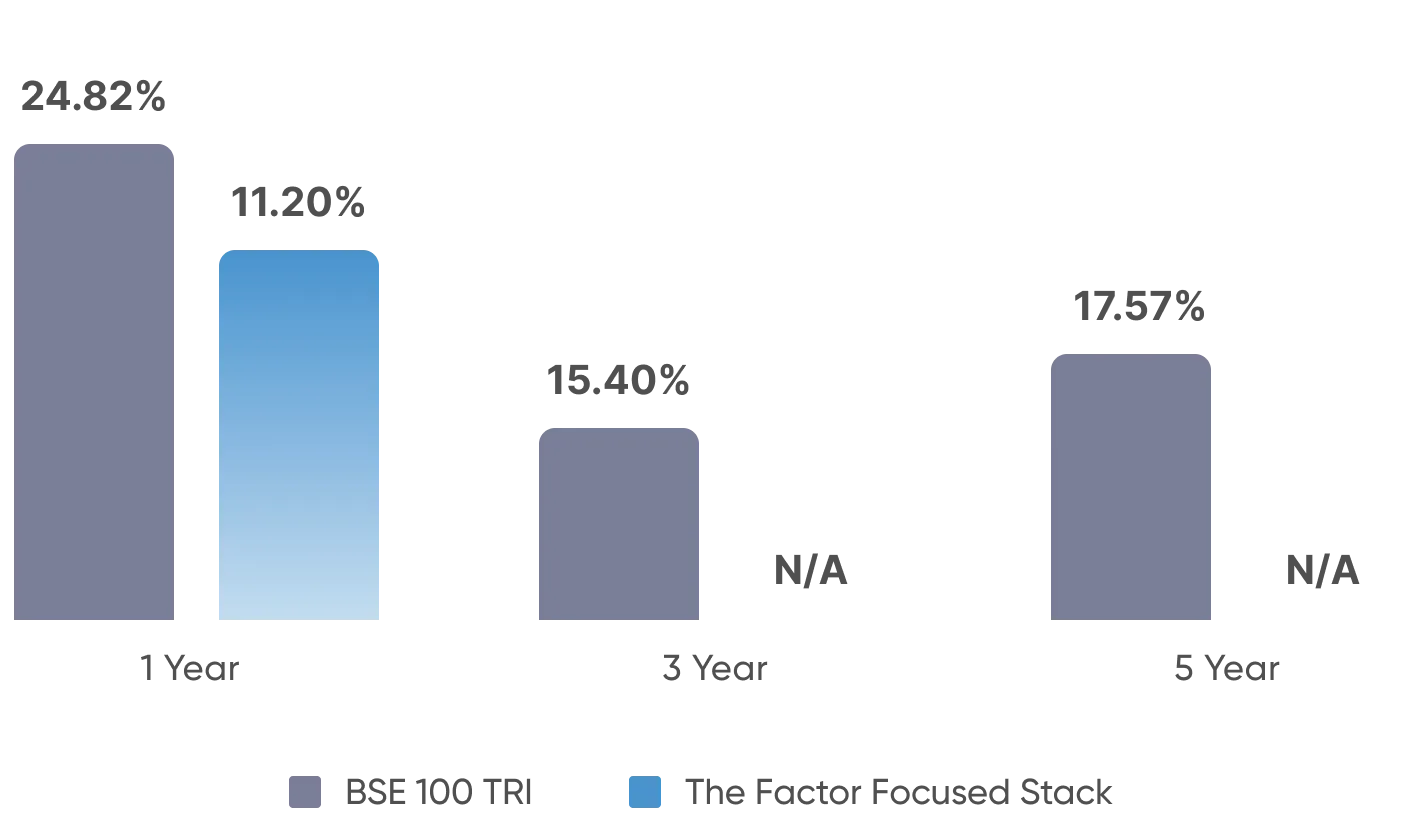

Annualized Past Returns

The Factor Focused portfolio encompasses a multi-factor strategy combining various attributes like value, growth, and low volatility to seek enhanced returns and diversification.

Who should invest in this?

Investors who are comfortable with potentially higher risk and returns, and who believe in the persistence of certain factors driving stock performance, are well-suited for factor investing.

However, individuals should possess the willingness to stay invested through market cycles, as factors can exhibit varying performance over time. Factor investing requires a proactive stance, making it particularly appealing to those who enjoy analyzing market trends and adjusting their strategies accordingly.