Our Ready-to-Retire portfolio has been crafted to maximize aggressive growth potential. Our portfolio seamlessly integrates a diverse mix of core and satellite strategies, complemented by a balanced allocation between active and passive funds. This portfolio keeps a keen focus on dynamic diversification. It also navigates market opportunities with agility, ensuring optimal risk-adjusted returns for investors.

What You Are Investing In

Our retirement investment strategy is designed to deliver steady growth and capture high-growth opportunities through a balanced and diversified approach. Here’s a detailed look at what we invest in:

- Quality Stocks

- Blue-Chip Companies: Investing in well-established, stable companies.

- Dividend-Paying Stocks: Focusing on companies offering regular dividends for reliable income and capital appreciation.

- High-Quality Bonds

- Government Bonds: Prioritizing low-risk, steady-return bonds from stable governments.

- Corporate Bonds: Selecting bonds from financially sound companies with strong credit profiles and higher yields.

- Diversified Index Funds

- Broad Market Exposure: Using index funds that track major indices for diversified market exposure.

- Sector-Specific Funds: Including funds focused on specific sectors like technology or healthcare for targeted growth.

- Emerging Markets

- Geographic Diversification: Investing in rapidly growing economies across Asia, Latin America, and Africa.

- Local Market Leaders: Identifying and investing in dominant companies in these regions.

- Niche Sectors

- Sustainable Technologies: Allocating funds to leaders in renewable energy and environmentally friendly technologies.

- Healthcare Innovations: Investing in biotech and pharmaceutical companies developing groundbreaking treatments.

- Innovative Technologies

- Tech Startups: Supporting early-stage companies with disruptive technologies.

- R&D-Heavy Firms: Investing in companies with significant R&D budgets driving future advancements.

By combining these various elements, we aim to build a resilient and robust portfolio capable of delivering consistent returns while navigating the complexities of the financial markets. Our approach ensures a blend of safety and growth, providing a well-rounded investment strategy tailored to achieve long-term financial goals.

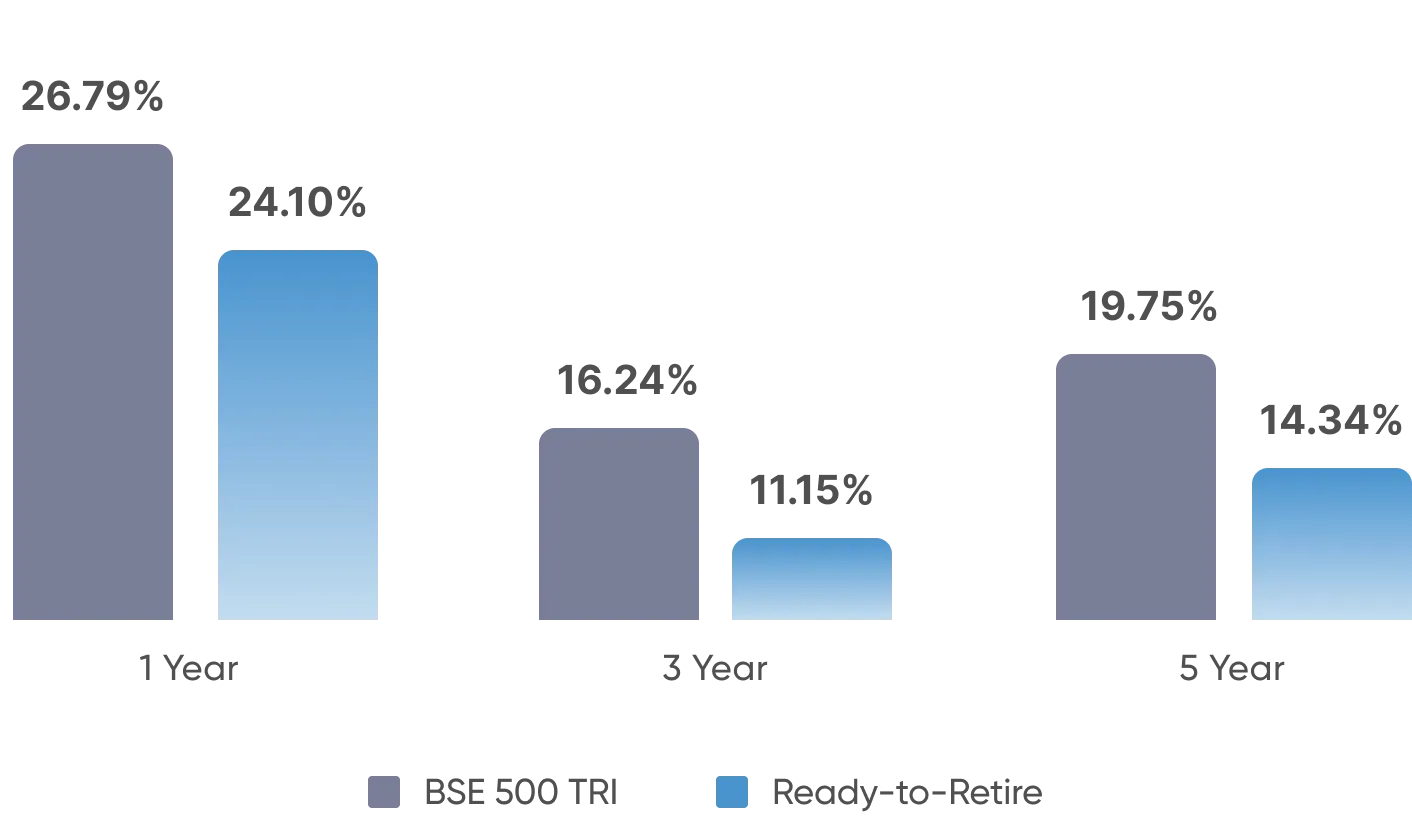

Annualised Past Returns

Our retirement portfolio has demonstrated impressive annualised returns over various time horizons. Over the past year, the portfolio delivered a return of 44.02%, significantly outperforming the benchmark Nifty 50, which returned 18.48%.

Risk Rating and Recommended Investment Horizon

Crafted to maximize aggressive growth potential, our portfolio seamlessly integrates a diverse mix of core and satellite strategies, complemented by a balanced allocation between active and passive funds. With a keen focus on dynamic diversification, we navigate market opportunities with agility, ensuring optimal risk-adjusted returns for our investors

Advantages of Ready-to-Retire

Ready-to-Retire is a mixture of healthcare, banking, factor-based and many more strategies, providing the following advantages:

Risk Spread Across Companies of All Sizes

By covering a wide range of companies, from large established firms to small emerging businesses, the investment portfolio is diversified, reducing the overall risk.

Optimized Returns Through Active Management

The fund manager has the flexibility to adjust the portfolio in response to market conditions, optimizing returns and managing risks effectively.

Captures Growth Across Market Segments

The portfolio is designed to capture growth from all market segments, ensuring that investors benefit from overall economic expansion.

Risks of Super Stack

Below are the risks that might come along with the investment. It is essential to consider them before investing in our retirement portfolio:

Higher Volatility in Returns

Due to the inclusion of companies of varying sizes and sectors, the portfolio may experience higher volatility in returns, with periods of significant fluctuations.

Complex Management Requirements

Effective portfolio management requires a deep understanding of various factors and businesses, making it crucial for the fund manager to be highly skilled and knowledgeable.

Active Rebalancing Necessity

The fund manager must actively rebalance the portfolio's market-cap allocation based on market movements, which requires diligent oversight and timely decision-making.

Current Holdings

Our Ready-to-Retire portfolio’s current holdings (as of 2024) reflect its diversified approach across various asset classes and investment strategies.

The Ready-to-Retire portfolio offers a strategically diversified investment approach tailored for those aiming for early retirement. By combining quality stocks, high-quality bonds, diversified index funds, and innovative sectors, the portfolio is designed to deliver steady growth and capture high-growth opportunities. With a balanced mix of active and passive management, it optimizes returns while mitigating risks. Despite the potential for higher volatility and the need for active rebalancing, the portfolio’s dynamic diversification and expert management provide a robust path toward achieving long-term financial goals. This makes it an ideal choice for investors seeking a resilient and growth-oriented retirement strategy.