What you are Investing

- Invest in a portfolio of companies that satisfy certain important principles laid down under the Shariah Law.

- Funds that will not invest in companies whose total debt exceeds 1/4th of its total assets.

- Funds that will not invest in companies whose interest income exceeds 3% of their total income.

- Funds that will not invest in Companies which is involved in businesses such as Tobacco, Alcohol, Financial Services such as Banks & NBFCs, Pork, Gambling, Nightclub activities or pornography

Investment Strategy

This fund mainly invests in Companies that satisfy the strict rules under the Shariah Law.

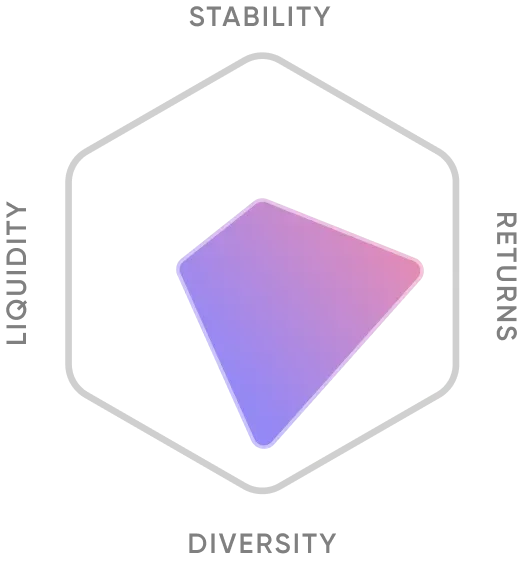

- This fund is ideal for investors looking to invest in a diversified equity fund without exposure to sectors such as Banking & Finance, Alcohol, Tobacco etc

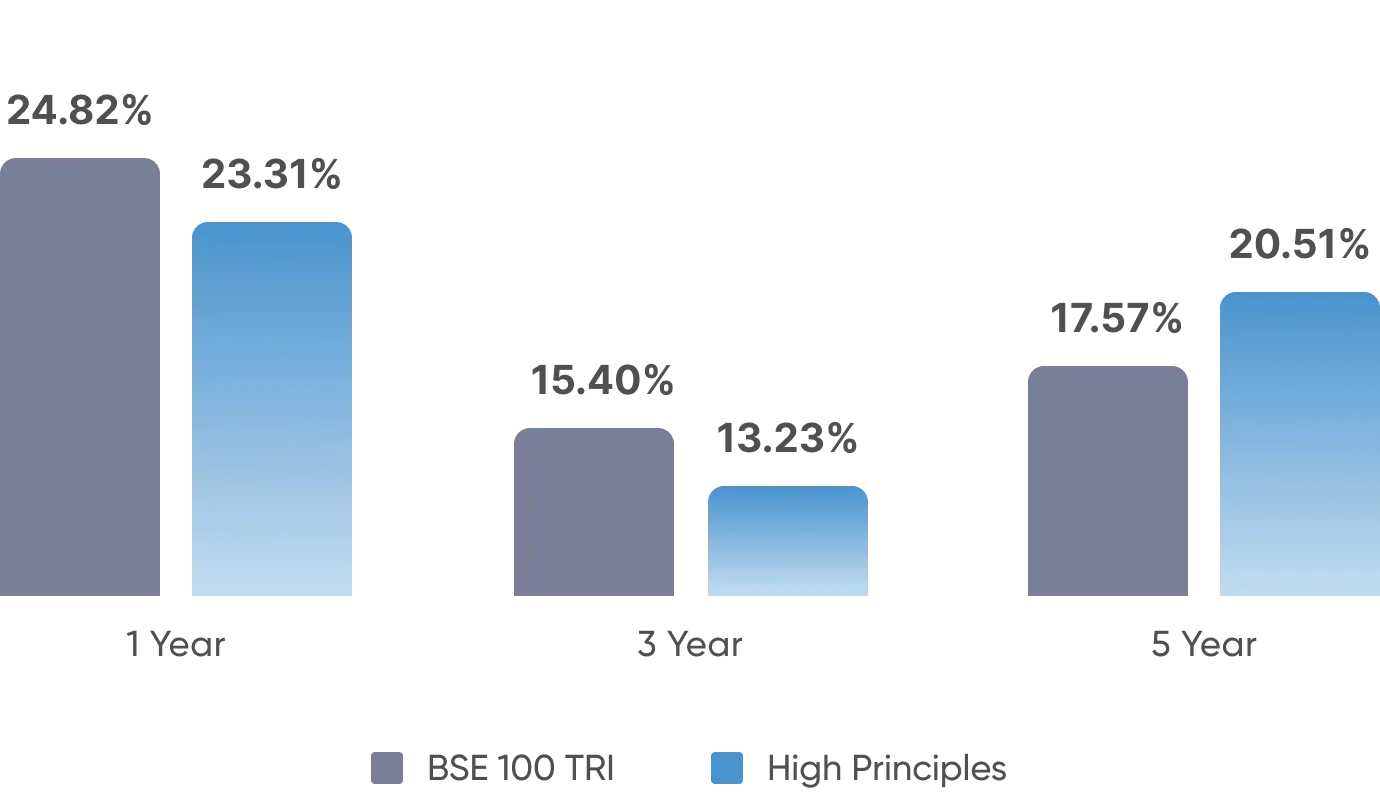

- This fund is suitable for investors seeking long-term capital appreciation of their wealth and those who wish to invest in equity and equity-related instruments of Companies that are Shariah Compliant.

Pros & Cons of High Principles Stack:

Who Should Invest

Investors who are willing to take on moderate to high risk and have a long-term investment horizon may consider investing in Shariah-compliant funds. These funds are typically best suited for investors who are looking to invest for the long term, at least 5+ years. Shariah Compliant funds are more volatile than their category average, so investors should be willing to accept some risk to potentially achieve higher returns.