Made for risk-takers who enjoy investing in multi-bagger stocks with high disruptive growth, attractive returns & that outperform the market indices significantly.

Small-Cap Companies

Small-cap companies are those with a market capitalization of less than $2 billion. They can be a lucrative investment opportunity because of their potential for high growth. They are also more likely to be innovative and disruptive, which can lead to significant gains for investors. Their potential for rapid growth is due to the fact that these companies are often in the early stages of their development.

Investment Strategy

The Small is Beautiful portfolio is a growth-at-a-reasonable-price (GARP) strategy that invests in small-cap companies with the potential to grow rapidly over the medium to long term. The portfolio focuses on companies with strong balance sheets, consistent earnings, and reasonable valuations. It also favours industries that are consolidating and avoids industries that are fragmenting.

- Companies with potential to grow earnings faster than the market, trading at a discount to intrinsic value.

- Look for companies with strong balance sheets, cash flow, and reasonable valuations compared to earnings and assets.

- Favour industries consolidating with fewer players and avoid industries fragmenting with more players.

What you are investing in

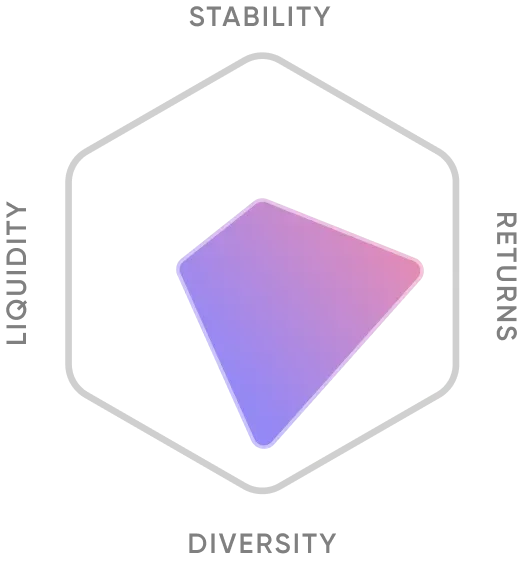

- Potent small-cap companies with slight exposure to large & mid-cap for stability.

- Emerging startups in sectors like tech, finance, hospitality and capital goods.

- Companies in wealth creation stage with growth potential & robust business models.

- Mid-cap & large-cap companies to stabilize volatility in changing market conditions.

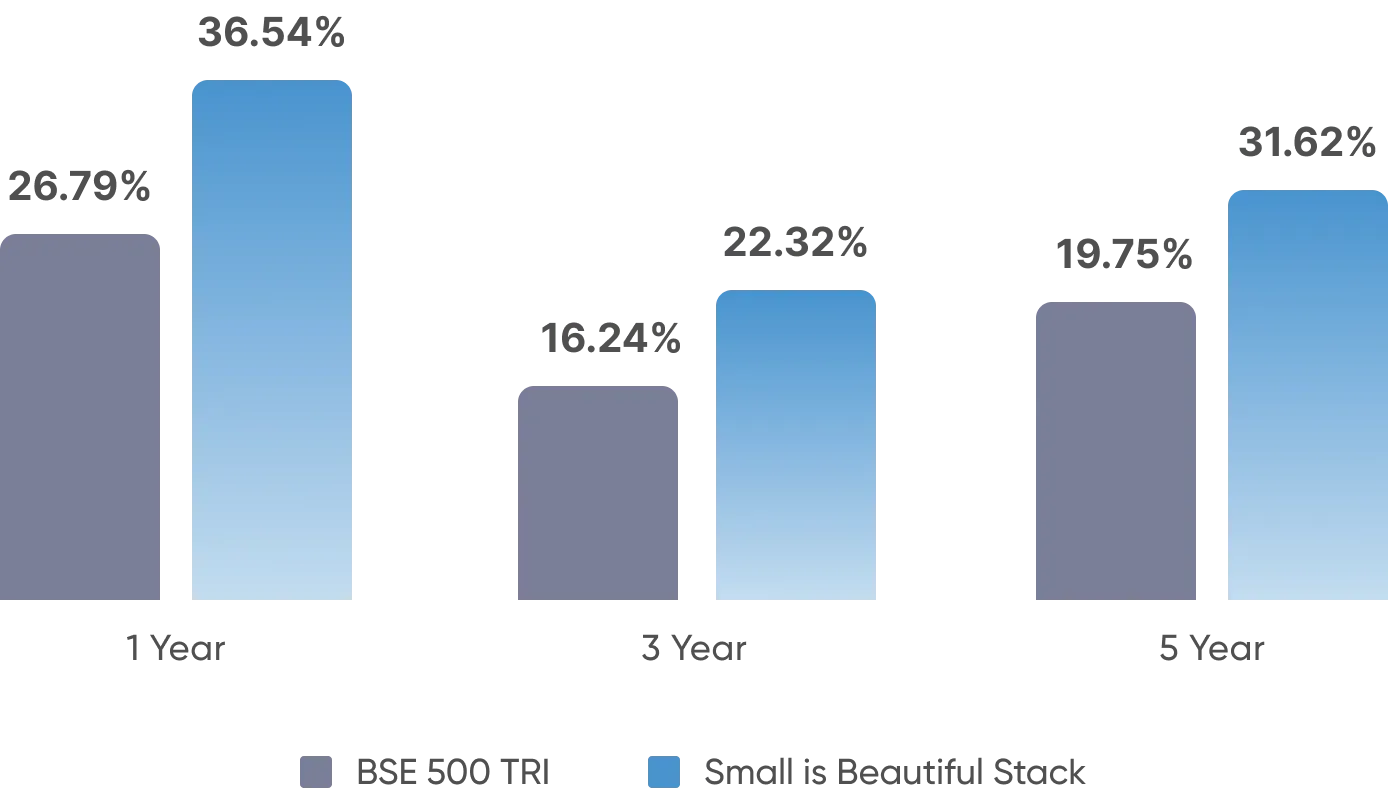

Historical Performance Against Benchmarks

The small-cap category is where most instances of active schemes outperforming indices can be seen. A large percentage of small-cap schemes have shown to consistently outperform their benchmark indices during a one, three and even five year investment horizon.

Pros & Cons of Small Cap Strategy

Who Should Invest?

Ideal for investors with an aggressive risk profile who are looking for long-term capital growth. These investors are willing to take on more risk in exchange for the potential for higher returns. Their financial goals could include: growing their wealth over the long term, achieving financial independence, and creating a legacy for their children or grandchildren. An investor looking to diversify their portfolio to give it the opportunity to generate additional alpha should consider investing in small-cap companies.