The Great Indian Middle-Class portfolio is a way to invest in the changing consumption patterns of millions of Indian households. As India's economy grows, so does the average Indian's disposable income. This means that people have more money to spend on things like food, clothing, entertainment, and travel. This is creating opportunities for companies that sell these products and services. It invests in businesses that are involved in these sectors, such as fast-moving consumer goods (FMCG), consumer durables, retail, multiplexes, hotels, and entertainment. By investing in this, you can get exposure to the growth of the Indian middle class and the opportunities it creates for businesses.

What you are investing in

- FMCG companies that focus on low per capita consumption, premiumization and other innovations.

- White goods companies with low penetration rates, electrification drive, and consumer finance.

- Stocks of companies engaged in consumer durables, non-durables, retail, textiles, auto OEMs, media & entertainment

- Companies involved in hotels, resorts & travel services, education services, airlines, e-commerce, consumer transportation & logistics services.

Investment Strategy

The portfolio will be managed using a fundamental, bottom-up approach that focuses on identifying growth companies with high return on equity (ROE) and sustainable competitive advantages.

- Invest across market capitalization and style, with a bottom-up approach to stock-picking within the consumption space.

- Invest in foreign securities including ADRs / GDRs / Foreign equity and debt securities.

- Maintain a concentrated portfolio of stocks, in sectors like FMCG, Autos, E-commerce, Media & Entertainment, Banks, Education, Transportation.

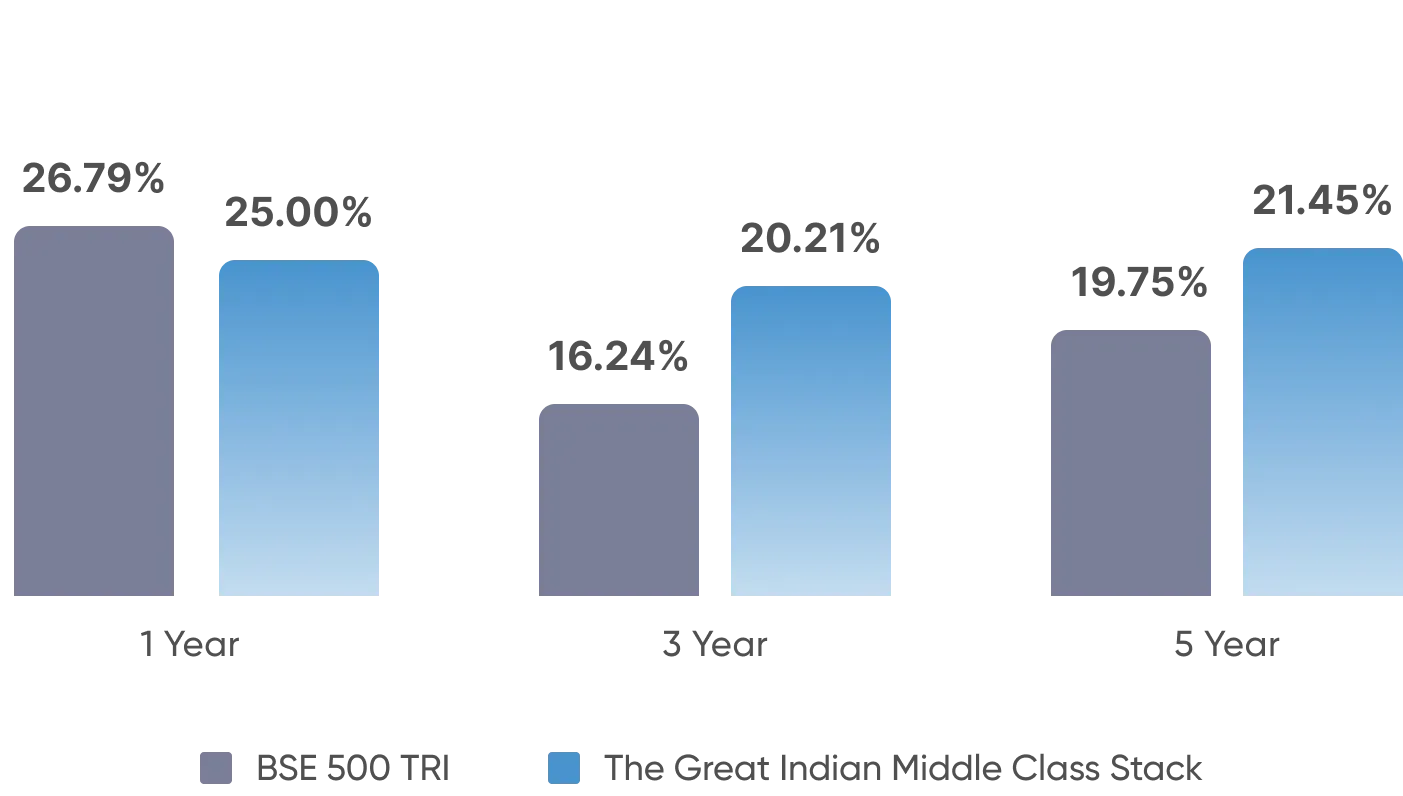

Historical Performance in Global Markets

Over the past 1, 3, and 5 years, most consumption space-focused funds have outperformed benchmark indices. The fund is benchmarked against the NIFTY India Consumption Index (TRI).

Pros & Cons of Great Indian Middle Class

Who Should Invest in this?

This portfolio is made for long-term investors who are willing to take moderate risk and are looking for capital appreciation. Investors should have a time horizon of at least 7+ years and should expect to see volatility in the short term. Investors should have a basic understanding of the consumption sector and the factors that can affect its performance.