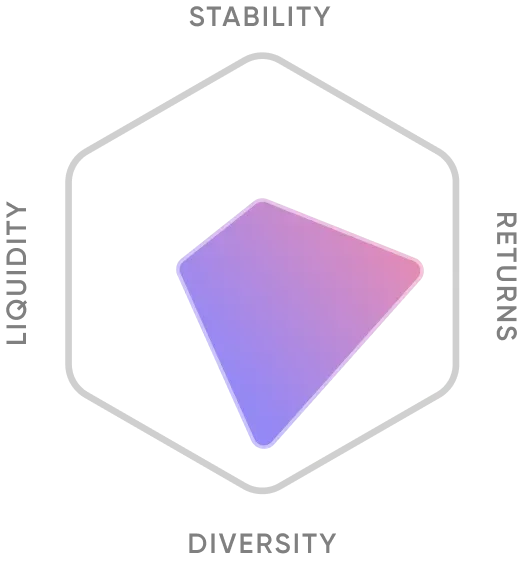

The Flexicap Kings portfolio aims to generate consistent returns through diversified investments across large-cap, mid-cap, and small-cap companies. Fund managers can achieve long-term capital growth by flexibly allocating investments across market capitalization segments based on market conditions. The goal is to achieve regular income and potential capital appreciation from the perfect mix of market capitalizations.

Investment Strategy

This portfolio combines three strategies to employ a flexicap investing strategy.

- Follow a bottom-up approach to stock selection and invest in companies that have strong fundamentals and growth potential.

- Look for stocks that are undervalued due to temporary factors, such as market sentiment or news events.

- Invest in a diversified portfolio of equity in various market capitalizations with an aim to beat benchmark returns.

What you are investing in

- A diversified portfolio of large-cap, mid-cap & small-cap companies.

- Large-cap companies with moderate returns, high stability & market value.

- Mid-cap companies offering a balance between growth potential and risk.

- Small-cap companies with higher growth potential than larger companies.

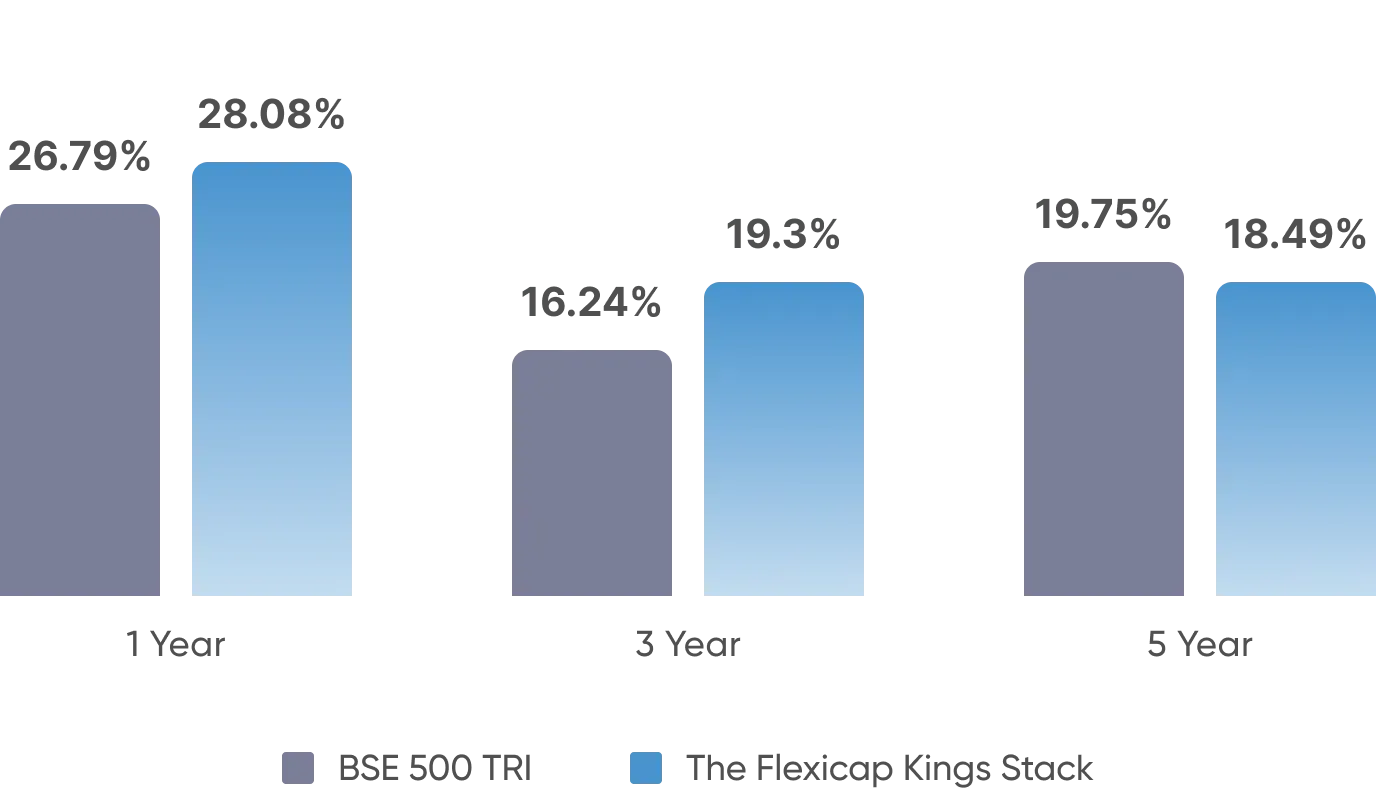

Historical Performance Against Benchmarks

Given the flexibility of the fund manager to be able to invest in stocks across different market capitalization segments, Flexicap funds typically tend to significantly outperform mainstream benchmark indices over multiple time periods as can be seen in the infographic below.

Who should invest in this?

The Flexicap Kings portfolio suits investors seeking a balanced approach. Those comfortable with a mix of large, mid, and small companies in their portfolio, and who believe in adjusting allocations based on market shifts, benefit from this strategy. Investors looking for diversification across market segments and the potential for growth at different economic stages will find this portfolio appealing.

However, individuals should be prepared for potentially higher risk and market volatility due to exposure to various sectors and sizes. Flexi cap is ideal for patient investors who trust skilled fund managers to navigate changing market dynamics effectively.