Investing in the banking sector presents a unique opportunity for those looking to capitalise on the growth of the Indian economy. The Banking Brilliance portfolio offers a diversified approach, focusing on high-growth investment within the Banking, Financial Services, and Insurance (BFSI) sector. Let's get into the details of this compelling investment opportunity.

Why Invest in Banking Brilliance?

Several factors are driving the banking sector's growth. First, loan default rates are reducing significantly, which indicates healthier loan books. Second, cost-to-income ratios are stabilising, reflecting improved operational efficiency. Third, deposit growth is at its highest since 2016, reflecting strong consumer confidence and financial stability. Lastly, UPI transactions have soared by 50% year-on-year, showcasing the sector's adaptability and growth potential.

Proven Track Record: Invest in banks with a proven track record of success, such as ICICI, Axis, HDFC, and SBI.

Top-rated Insurance Companies: Includes ICICI Lombard General Insurance and SBI Life Insurance.

Healthy Mix of Companies: A mix of companies in banking, finance, capital markets, and IT services.

What are you Investing in?

Investing in Banking Brilliance means getting into the potential growth of the banking sector in India. This portfolio offers a diverse mix of high-performing banks, insurance companies, and financial services, aiming to capitalise on the sector's stability and dynamism. Investing in the Banking Brilliance portfolio means diving into a selection of top-performing mutual funds that target different segments of the financial market. Here's a closer look at the specific mutual funds included in this portfolio, each chosen for its potential to capitalise on the growth and stability of the BFSI sector:

ICICI Prudential Multi-Asset Fund Direct Plan Growth: A fund that invests in a mix of asset classes, providing diversification and reducing risk.

HDFC Corporate Bond Fund - Direct Plan - Growth Option: Focuses on high-quality corporate bonds, offering stable returns and lower risk.

ICICI Prudential Liquid Fund Retail Growth: Ideal for short-term investments, this fund provides liquidity and steady returns.

Kotak Bluechip Direct-Growth: Invests in large-cap stocks, offering stability and growth potential.

Kotak Gold Fund Growth - Direct: Gives exposure to gold, helping to hedge against inflation and diversify your portfolio.

HDFC Mid-Cap Opportunities Fund - Direct Plan - Growth Option: Targets mid-cap stocks, aiming for higher growth potential over the long term.

ICICI Prudential Bluechip Fund Growth: Focuses on large-cap companies with strong track records, providing a balance of growth and stability.

Axis Small Cap Fund Direct-Growth: Invests in small-cap companies, offering higher growth potential with increased risk.

SBI Multi Asset Allocation Fund Regular Growth: Diversifies across various asset classes, reducing risk while aiming for steady returns.

HDFC Flexi Cap Fund Growth: Invests in companies of all sizes, offering flexibility and potential for high returns.

By including these funds in the Banking Brilliance portfolio, we ensure a diversified investment approach that balances risk and return, capitalising on the robust performance of well-established financial institutions while benefiting from the dynamic growth in various financial sectors.

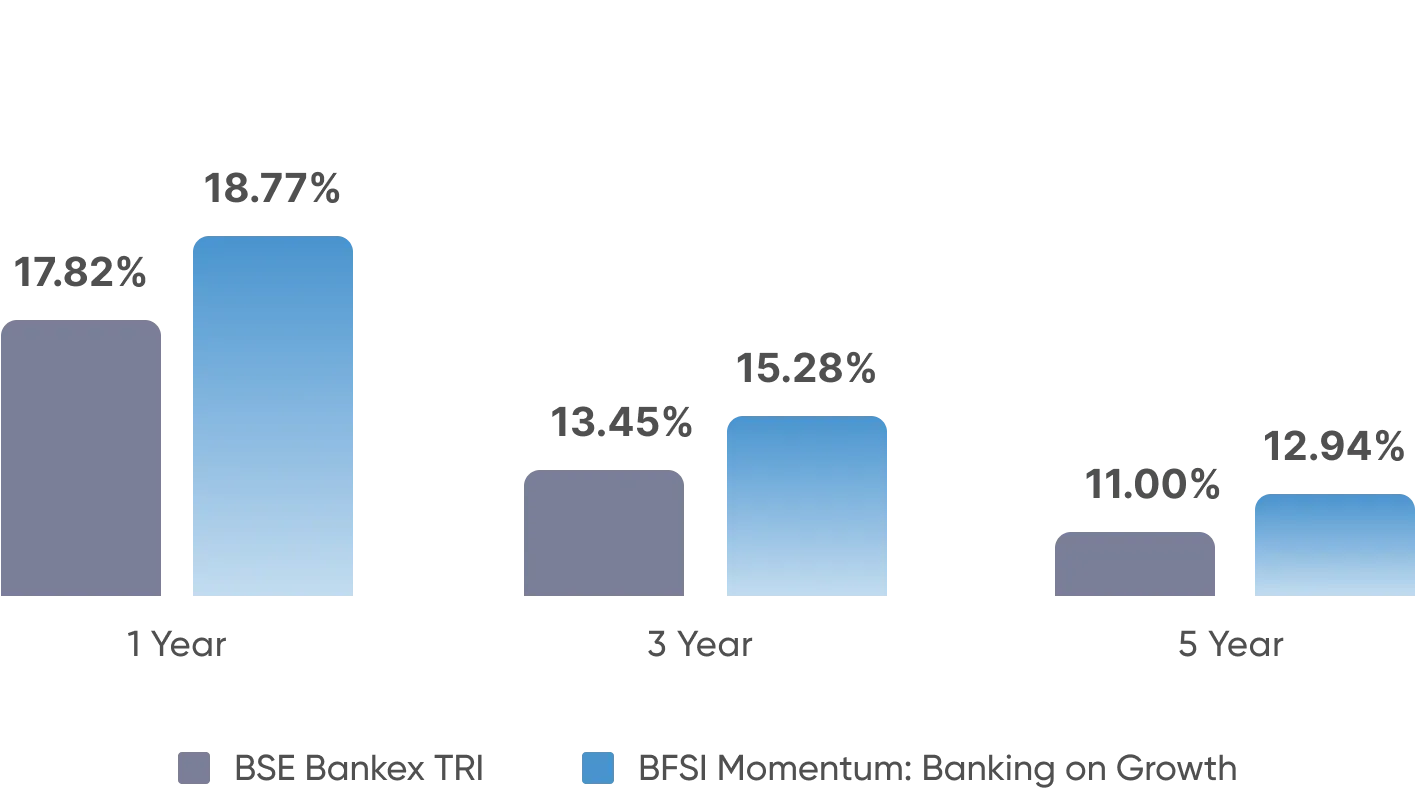

Annualised Past Returns

Understanding the annualised past returns of an investment can help you determine its performance over time. By looking at how the Banking Brilliance portfolio has performed in the past, you can get a sense of its growth potential and stability. Let's look at the annualised returns over different periods to see how this investment has fared.

By maintaining a diversified portfolio, we strike a balance between stability and growth potential. This approach ensures that we leverage the robust performance of well-established banks while benefiting from the dynamic growth in the non-banking financial sector.

Who should invest in Banking Brilliance?

This investment option is designed for investors who prefer a balanced approach and are comfortable with a mix of companies in their portfolio in the banking, financial services, and insurance (BFSI) sector. It is ideal for those seeking diversification and potential growth at different economic stages.

However, due to the aggressive risk profile, investors should be prepared for higher risk and market volatility. This investment option is suitable for individuals aged between 18 and 50 with an investment horizon of 5 years or more. Competitive returns are expected, and it is well-suited for financial goals such as wealth creation, asset diversification, and education planning.

Advantages and Risks of Sectoral-Banking Mutual Funds

Investing in sectoral-banking mutual funds can offer great benefits, but it's essential to understand both the benefits and the risks involved. These funds provide a chance to profit from the growth of the banking sector, but they also come with potential challenges. Let's break down what you need to know about the advantages and risks of these specialised investments.

The Banking Brilliance portfolio offers an opportunity for investors looking to tap into the growth of the Indian banking sector. With a diverse mix of high-performing banks, top-rated insurance companies, and financial services, this investment strategy balances stability with the potential for significant returns. By understanding the dynamics of the BFSI sector and implementing a thoughtful investment approach, you can capitalise on the sector's promising future. However, being aware of the associated risks and market volatility is essential. Investing wisely and seeking advice from financial experts can help you navigate these challenges effectively.