Opportunities

Opportunities

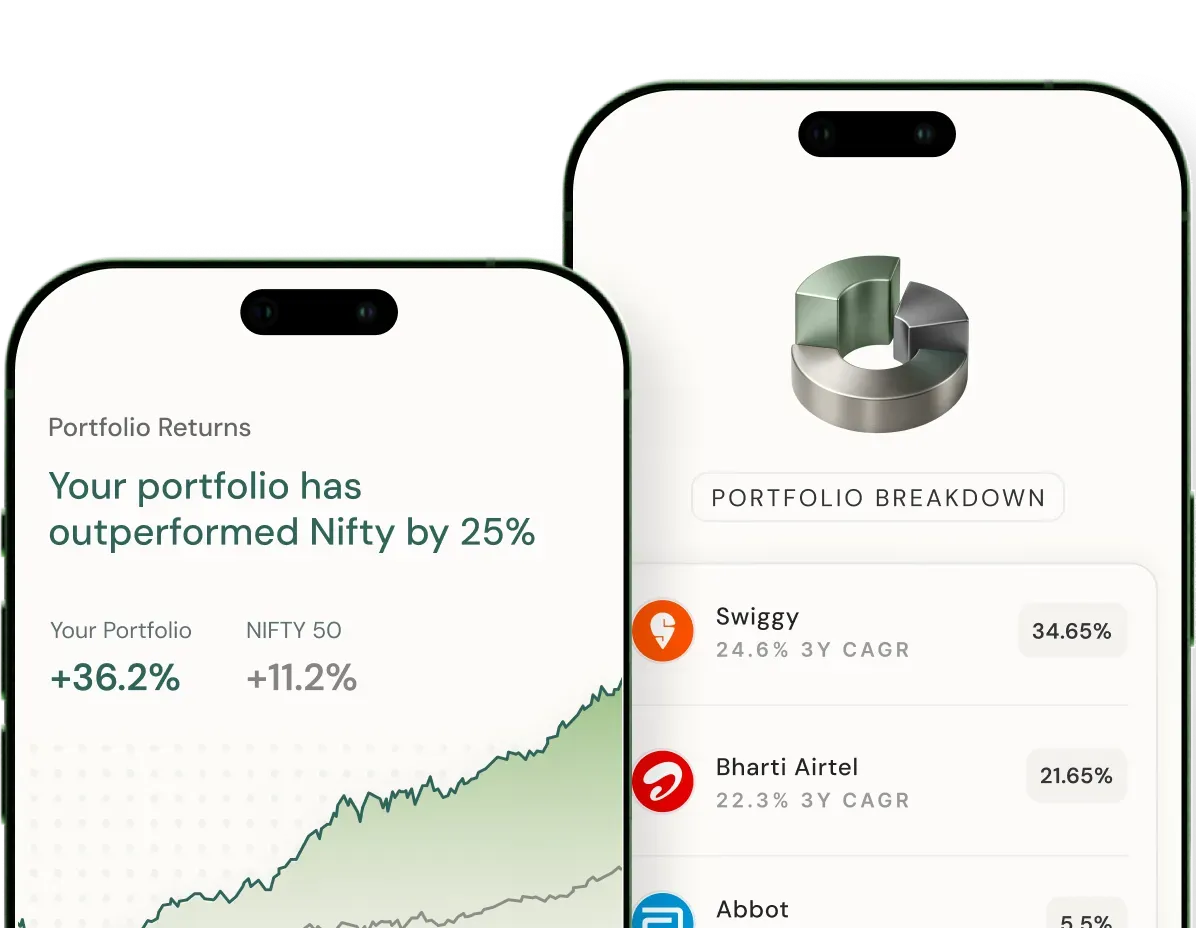

mutual fund strategies for super-high returns

powered by

Opportunities are a set of unique investment themes, each with its own investment objective and time horizon.

introducing Opportunities

higher returns with thematic strategies

Opportunities cover a wide range of investment opportunities, from factor strategies to long-term themes. Through Opportunities, you can easily select ready-made thematic portfolios that align with your investment goals. We have curated exciting long term investment themes in the market using our proprietary selection framework called CASPeR to complement your core portfolio, & generate additional alpha.

the Opportunities advantage

why invest in

Opportunities?

Opportunities is a collection of thematic strategies that include taking exposure to emerging markets, various market capitalizations, quantitative & qualitative investing strategies and sectors supported by government schemes. These offer several advantages including:

High growth potential

Leveraging the promise of burgeoning market themes.

Diversification

Achieving a well-rounded portfolio by incorporating various market factors.

Riding market trends

Aligning with and profiting from evolving investment dynamics.

explore your Opportunities

Ultimate Value

5+ Years investment horizon

33%

3 year CAGR

14%

NIFTY 500 TRI - 3Y CAGR

A long-term investment strategy that invests in undervalued companies with solid fundamentals.

Factor Focused

3+ Years investment horizon

12.45%

5 year CAGR

14%

NIFTY 500 TRI - 3Y CAGR

Ideal for quant geeks, this portfolio employs attributes like low volatility and high momentum, capturing distinct risk-return profiles in stocks.

Flexicap Kings

5+ Years investment horizon

19.6%

5 year CAGR

14%

NIFTY 500 TRI - 3Y CAGR

The flexibility to invest in companies of various sizes, aiming for optimal returns by adjusting your portfolio composition based on market conditions and opportunities.

Large & Midcap

5+ Years investment horizon

37.48%

3 year CAGR

14%

NIFTY 500 TRI - 3Y CAGR

Curated for those who intend to gain exposure to well-established, mature companies with a history of consistent financial performance.

Small is Beautiful

3+ Years investment horizon

12.45%

5 year CAGR

14%

NIFTY 500 TRI - 3Y CAGR

Made for risk-takers who enjoy investing in multi-bagger stocks with high disruptive growth, attractive returns & that outperform the market indices significantly.

Building India

5+ Years investment horizon

17.82%

5 year CAGR

14.76%

NIFTY 500 TRI - 5Y CAGR

A portfolio that aims to ride the secular high growth opportunities in the Indian infrastructure space such as roads, railways, ports, and power.

Let's Go Global

7+ Years investment horizon

11.05%

1 year CAGR

%

A portfolio that offers an opportunity for international diversification. Invest in some of the leading global businesses, the cream of the crop names from America to Asia to Eastern Europe and beyond.

Atmanirbhar Bharat

5+ Years investment horizon

22.94%

1 year CAGR

15.85%

NIFTY 500 TRI - 3Y CAGR

A portfolio that invests in companies engaged in manufacturing activities along with following a business cycles-based investing theme giving you an opportunity for wealth creation alongside the growing Indian economy.

Great Indian Middle-Class

7+ Years investment horizon

14.3%

5 year CAGR

25.37%

NIFTY 500 TRI - 3Y CAGR

A portfolio for long-term capital appreciation by investing in a basket of stocks benefiting either directly or indirectly from the rising consumption-led demand in India.

All that Glitters

3+ Years investment horizon

15.5%

1 year CAGR

%

A portfolio that invests in precious metals like gold & silver to hedge your portfolio against inflation while generating steady returns proportional to the growth of rising commodities.

High Principles

5+ Years investment horizon

17.82%

5 year CAGR

14.76%

NIFTY 500 TRI - 5Y CAGR

Participate in India’s growth story in a socially responsible way. Invest in funds that adhere to the strict rules laid down under the Shariah Law.

Opportunities are a unique way to invest and give your portfolio the edge of growth.. By focusing on specific investment themes, such as emerging markets, market trends, international growth, and booming sectors, Opportunity Stacks can help investors to unlock the potential of these areas and build a portfolio for long-term wealth creation with market-beating returns.