Large and mid-cap companies are less risky than small-cap companies and have the potential to generate good returns in the long term. By avoiding small-cap companies, investors can reduce their risk and focus on companies that generate consistent returns over time. The Large & Midcap portfolio consists of companies that are more established and have a track record of profitability. This makes them less likely to fail or go bankrupt. These companies can grow their businesses and generate profits leading to higher stock prices.

Investment Strategy

This portfolio combines multiple principles to employ a large & midcap investing strategy.

- Explore steady companies growing at reasonable prices. Invest less in popular sectors.

- Generate steady cash flow & efficient capital allocation. Capture emerging segments of the economy.

- Explore companies with potential for above-average growth.

What you are investing in

- A balanced portfolio of large-cap & mid-cap companies.

- Emerging sectors like financial services and capital goods.

- Domestic companies expected to outpace global markets.

- Other sectors like healthcare, automobile, IT and FMCG.

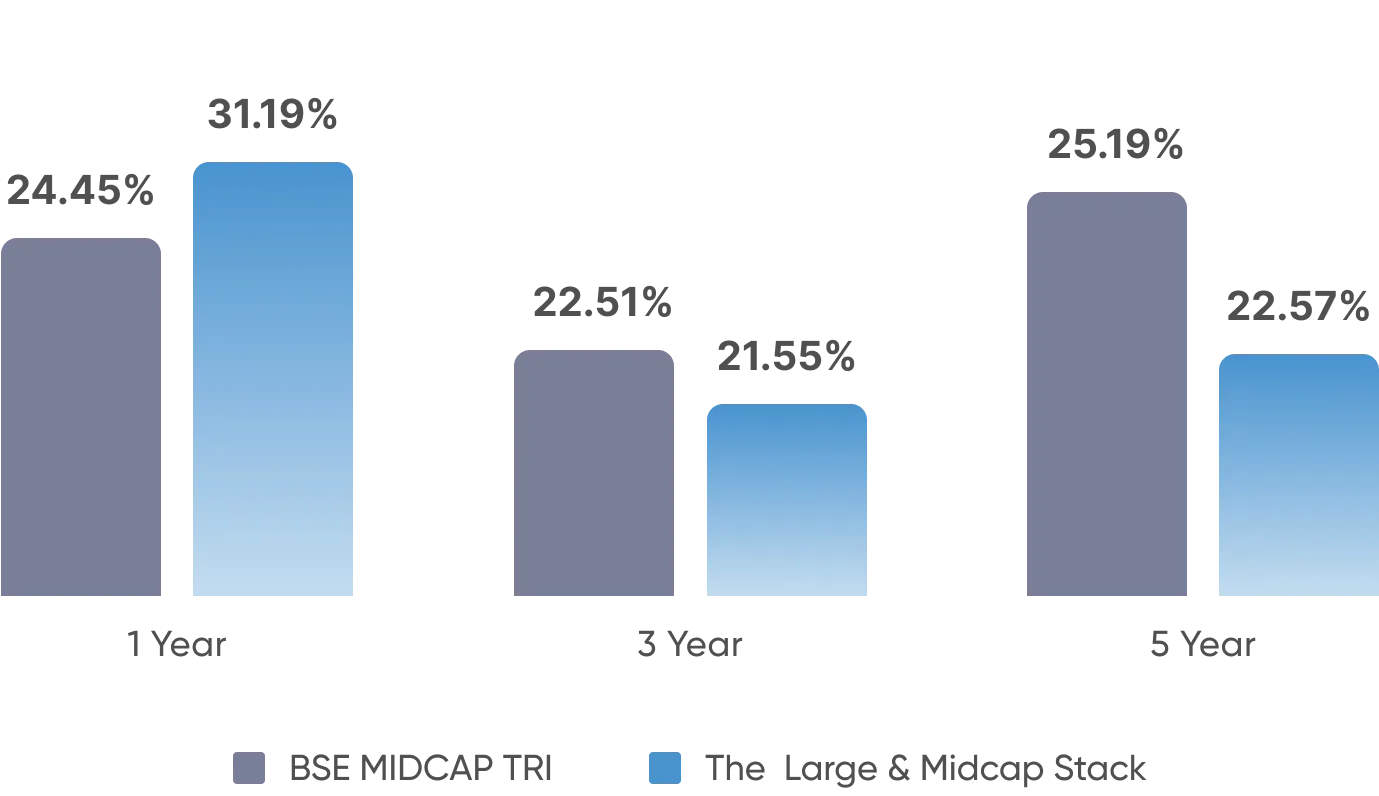

Historical Performance Against Benchmarks

As the investment horizon increases, the probability of strong performance increases & the possibility of a loss declines. The average 3 to 5-year performance of a regular portfolio with large-cap & mid-cap exposure remains largely in the ~14-15% range.

Pros & Cons of Large & Mid-cap Strategy

Annualized Past Returns

The Large & Midcap portfolio allocates your investment to the perfect mix of large-cap, & mid-cap companies to maximize your returns while minimizing short-term volatility.

Who should invest in this?

A person who is looking for a conservative investment with potential for growth should invest in the Large & Midcap strategy. Large-cap and mid-cap companies are less risky than small-cap companies and have the potential to generate good returns over the long term.