Invest Like the Top 1%

with a Portfolio built for you

Where Expertise Meets Technology — For Your Long Term Wealth

Smart Investing, Backed by Trust

Registered Clients

Registered advisors

Supported on India's largest brokers

of investment expertise

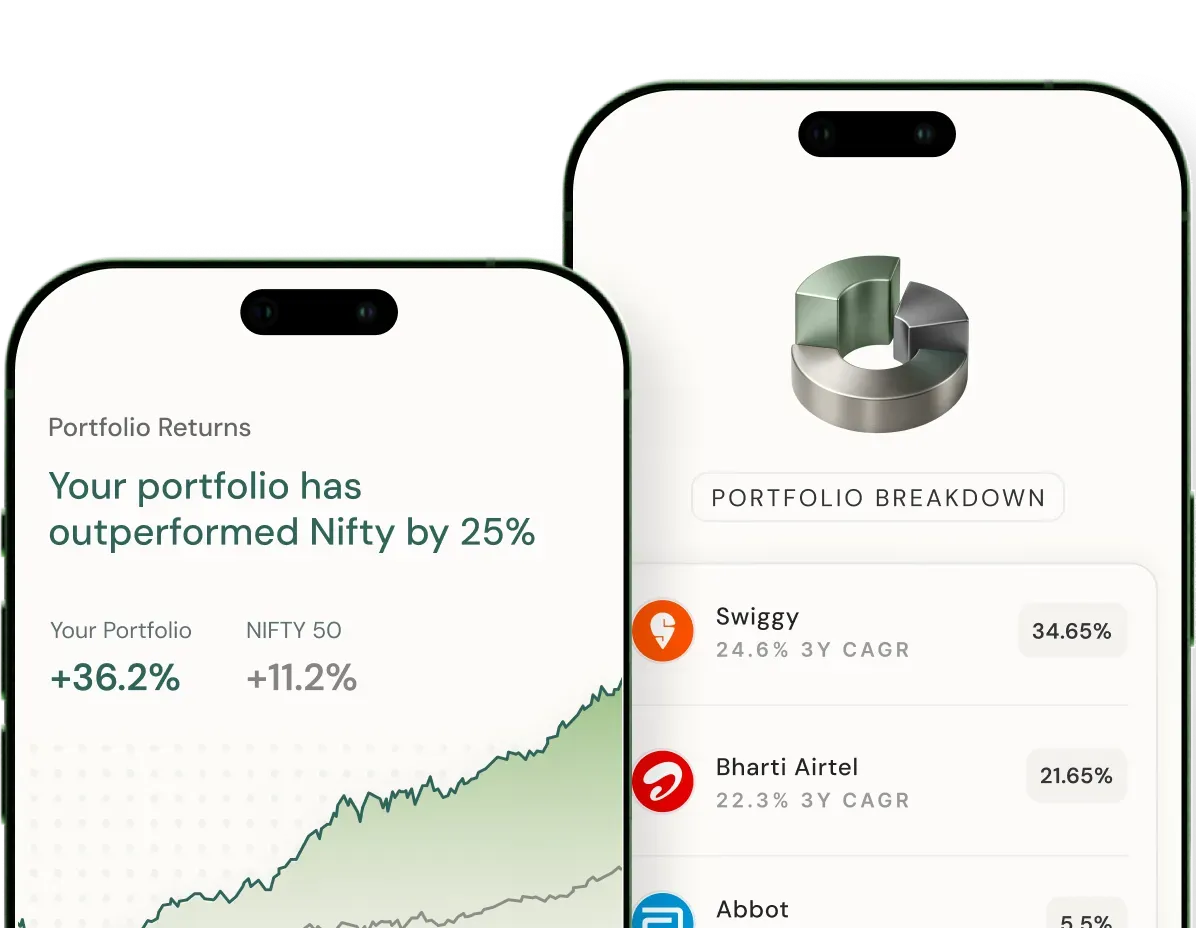

How does Stack Wealth

build wealth for you?

We'll customize portfolio depends on you, your goals, liquidity needs and risk profile.

Expert Investment Advisory

Flagship

A stable, well-diversified portfolio built for long-term wealth creation.

Opportunities

A tactical portfolio targeting short-term high-growth stock picks.

Momentum

A dynamic portfolio that rides trending stocks with strong upward price movement.

Get your portfolio reviewed from experts

We will identify underperforming assets and recommend alternatives to boost your potential returns.

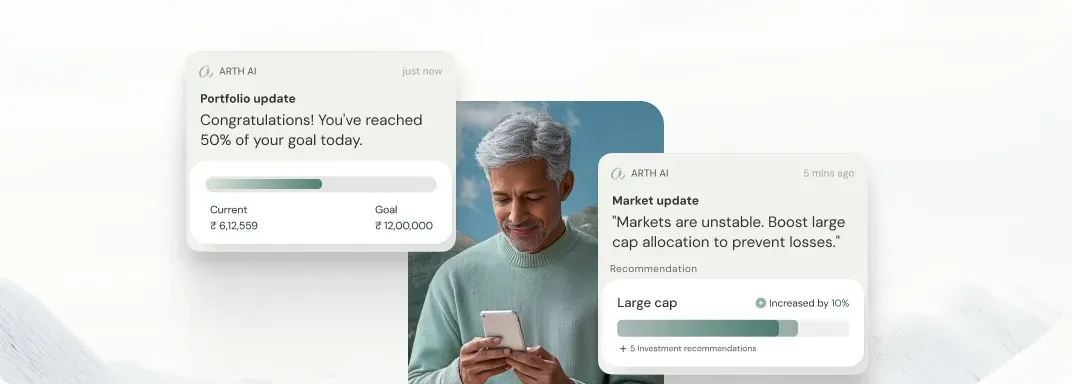

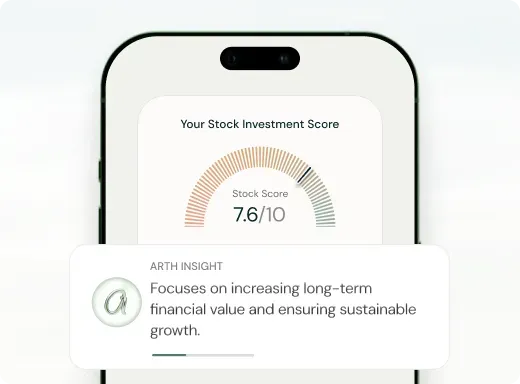

Introducing Arth AI

Arth AI acts as your personal CFO — offering tailored financial insights, portfolio strategies, and smart decision-making support, just like a full-time finance expert would.

Smarter Portfolio Insights

Know updates, insights on your stock portfolio and its performance

24/7 Financial Help

Answers to all your personal finance questions, anytime.

What they say about Stack Wealth

"Stack Wealth gives clear, data-backed market updates. I understand trends, indices, and sectors instead of relying on random Telegram tips."

"Stack Wealth monitors my portfolio and rebalances when needed, so my investments stay aligned without daily stress."

"My portfolio is now goal-based and built around my risk profile, with proper diversification instead of guesswork."