Making Investing in India Smarter & Simpler

At Stack Wealth, we started with a mission to make wealth creation accessible to all. It’s not just about strategies or portfolios.

22.7%

Average Returns

₹1,000+ Cr

AUM

1+ Lac

Investors

Our Story

Breaking Barriers, Building Wealth - Our Mission

For decades, wealth management in India was a privilege reserved for the ultra-rich. Retail investors were left with two extremes - DIY platforms with tools but no real guidance, or legacy wealth managers who charged steep fees and stayed out of reach.

We saw a new India emerging - an ambitious, fast-growing affluent class with rising incomes, global exposure, and a hunger to grow their wealth. This audience deserves better.

We’re a modern wealth manager for ambitious professionals - combining the sophistication of a private investment office, the ease of intelligent software, and the warmth of human advisors. From navigating equity compensation and liquidity to retirement and investing, we guide our clients at every step, always with their best interests first.

At Stack Wealth, we’re on a mission to democratise investing for India’s emerging affluent - turning every ambitious investor into a confident wealth builder.

Meet the Minds Behind Your Money

Smriti Tomar

Founder & CEOA former banking professional with global finance experience at Citibank, Smriti is deeply passionate about making personal finance accessible to all. An NIT graduate and wealth-tech entrepreneur, she founded Stack Wealth with a vision to democratise sophisticated wealth management for India’s emerging affluent. Smriti leads client relations, investments, and the wealth management team to ensure every Stack Wealth client enjoys a seamless, high-impact experience.

Tushar Vyas

Co-Founder & COOAn IIT Delhi graduate and two-time entrepreneur, Tushar brings a unique blend of product vision and technical expertise. Formerly with Nanoclean Global and a recipient of the President’s Award for Innovation, he has a proven track record of building impactful solutions. At Stack Wealth, he drives product strategy and operations to deliver a seamless, world-class investing experience.

Yashwardhan Pauranik

Co-founder & CTOWith 10+ years in tech, Yashwardhan has helped build and scale products for household names like AIESEC and Appointy Inc. At Stack Wealth, he drives technology and architects our robust, secure, and high-performing platform—ensuring every client enjoys a seamless experience backed by world-class technology.

Niranjan Goyal

Chief Investment OfficerA SEBI-Registered Investment Advisor, Chartered Accountant, and Certified Research Analyst with over 25 years of experience in capital markets and portfolio management. Niranjan leads Stack Wealth’s investment strategy, combining deep market insight with disciplined research to deliver consistent, client-focused outcomes

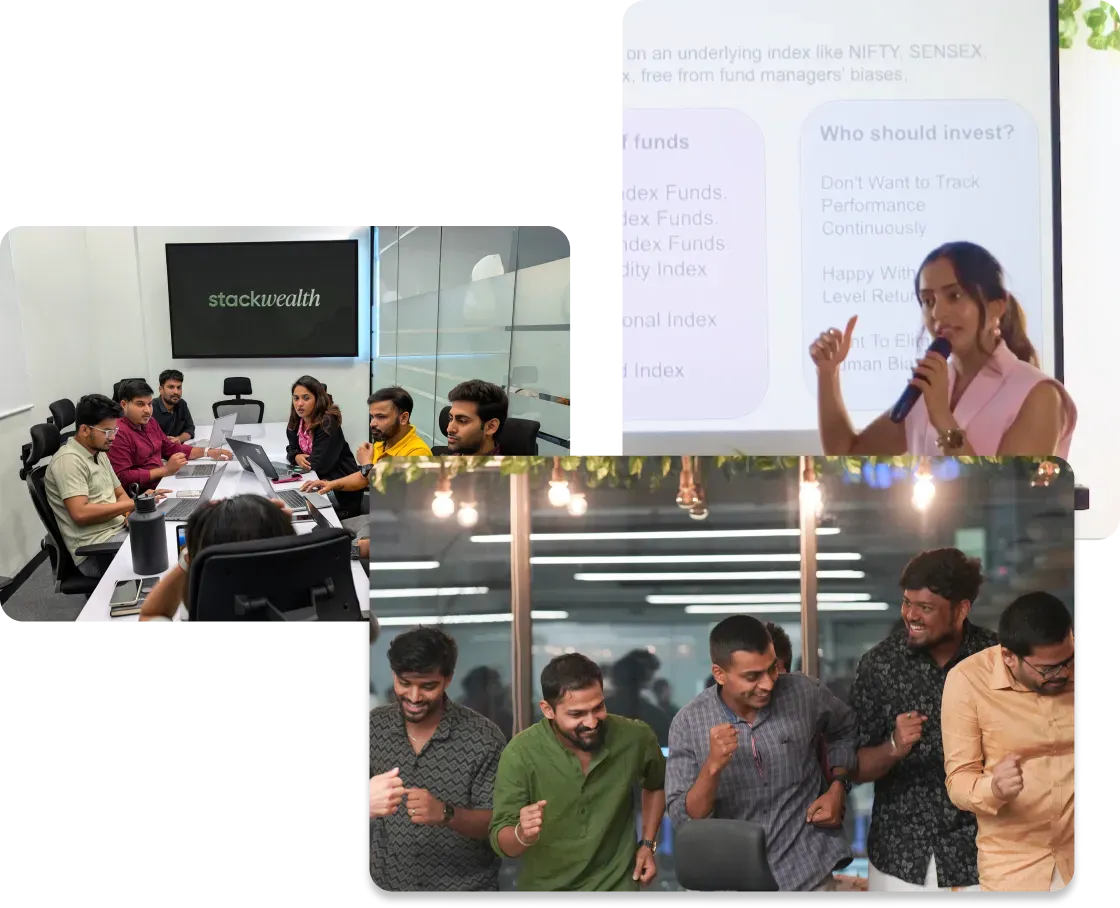

TEAM

A powerhouse team blending finance, tech, and vision - building the future of wealth in India.

We’re growing fast. Come grow with us